Cost Reduction in Long-Term Storage with Intelligent S3 Lifecycle Policies

Faster System Recovery Through Automated BCDR Strategy and Testing

Seamless Migration to PostgreSQL with Zero Downtime and Real-Time Data Sync

Centralized Infrastructure Visibility Enabled by Integrated Observability Stack

Company Overview

HDFC is one of India’s largest and most trusted financial institutions, known for its leadership in banking, financial services, and digital innovation. With a vast customer base and a focus on secure, efficient operations, HDFC uses technology to support compliance-driven, scalable financial services for both retail and enterprise clients.

Story Snapshot

As transaction volumes grew and digital compliance expanded nationwide, HDFC partnered with Cygnet.One to modernize its cloud infrastructure on AWS. The focus was on improving scalability, optimizing storage, automating recovery, and building observability into its platform. The result was a robust, secure, and efficient system built to handle tax and financial data reliably at scale.

At a Glance

HDFC worked with Cygnet.One to enhance its cloud environment and address rising demands across storage, backup, and observability. By shifting to an AWS-based modern architecture, HDFC improved scalability, ensured better operational control, and reduced storage overheads. The work laid the foundation for consistent performance and improved resilience.

|

Solutions Implemented |

Outcomes Achieved |

|

Transitioned from MSSQL to a self-managed PostgreSQL environment on Amazon EC2, offering enhanced flexibility and control |

50% Cost Efficiency – Achieved significant storage savings through automated log management and right-sized retention |

|

Automated backup workflows for Amazon EBS and EFS using AWS Backup to meet robust RPO/RTO targets |

75% Faster Recovery – Reduced system recovery time through tested and validated BCDR processes |

|

Introduced S3 Lifecycle Policies to streamline long-term log storage and support regulatory data retention requirements |

Enhanced Monitoring – Centralized visibility and alerting across infrastructure for proactive operations and compliance assurance |

|

Enabled real-time observability through an integrated CloudWatch, OpenSearch, and Grafana monitoring stack |

Seamless Database Migration – Real-time data replication via AWS DMS ensured a smooth shift to PostgreSQL without service interruption. |

Modernizing Secure Banking Infrastructure with Scalable Cloud-Native Architecture on AWS

As digital banking and compliance take center stage in India’s financial ecosystem, institutions like HDFC are responsible for processing large volumes of sensitive data with precision, security, and speed. HDFC serves as a trusted channel for secure transactions, regulatory reporting, and customer-facing operations, powered by stable, high-performance systems and well-defined governance controls.

With transaction volumes increasing and infrastructure demands becoming more complex, HDFC identified an opportunity to modernize its backend systems. The goal was to create a more scalable, secure, and cost-efficient foundation, one that would not only support future expansion but also simplify infrastructure management and maintain uninterrupted service availability for critical workloads.

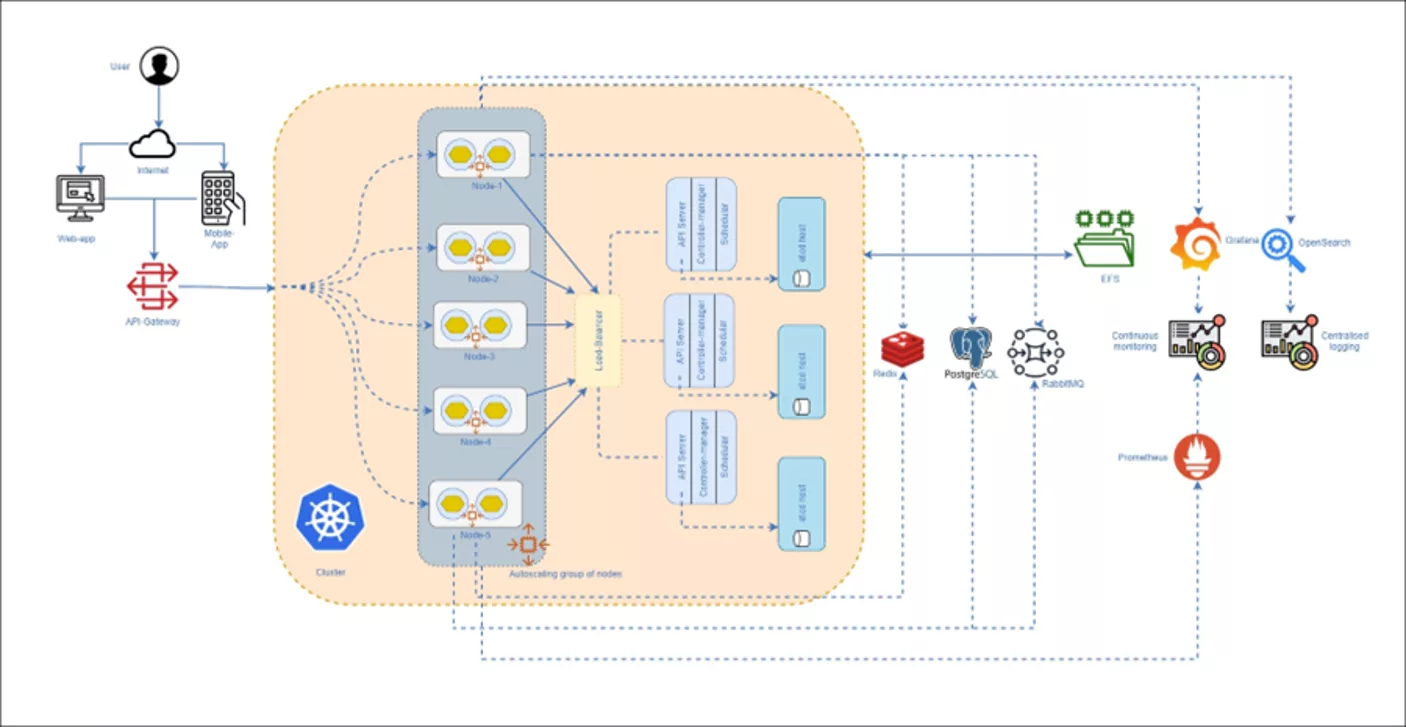

To support this initiative, HDFC partnered with Cygnet.One to modernize its cloud infrastructure on AWS. The engagement focused on replacing traditional MSSQL workloads with PostgreSQL, introducing automated S3 Lifecycle Policies to optimize long-term storage, and strengthening business continuity with structured backup and recovery strategies. In parallel, HDFC adopted an integrated observability stack to gain real-time visibility into infrastructure health, performance, and risk signals.

The modernization brought not only architectural clarity but also operational efficiency. Through automation of database management, backup routines, and monitoring alerts, HDFC reduced the need for manual oversight, cut down recovery times, and gained transparency into ongoing operations. These improvements were implemented without compromising the compliance, audit readiness, or security controls required for handling regulated financial data.

With its cloud infrastructure now modernized and optimized, HDFC is well positioned to continue supporting critical services with high availability, strong data integrity, and the ability to scale dynamically in step with market growth and evolving digital demands.

Problem

HDFC operated a robust and high-performing infrastructure that successfully supported its critical role in India’s financial and compliance landscape. As service demand steadily increased, the organization proactively recognized the need to evolve its backend systems to support greater scale, cost-efficiency, and operational automation, ensuring long-term sustainability and consistent responsiveness to market requirements.

The existing setup included MSSQL databases, manual backup workflows, and a growing repository of S3-stored logs without lifecycle automation. While this configuration had supported the organization’s needs effectively over time, the leadership team saw a clear opportunity to drive further optimization and operational maturity:

- SQL Server licensing and scaling introduced rising infrastructure costs that could be better managed through open-source PostgreSQL

- Amazon S3 log storage was designed for compliance but lacked automated expiration, steadily contributing to inflated storage bills

- Backup and recovery activities required manual intervention, placing additional load on operations and increasing recovery timelines during incidents

- Monitoring and alerting tools were in place but operated in silos, making it harder to maintain centralized visibility and enforce consistent response workflows.

To maintain reliable service delivery and meet growing expectations for performance and uptime, HDFC sought to implement a future-ready infrastructure. The goal was to enable real-time system insights, reduce manual dependencies, improve cost transparency, and support scalable performance aligned with evolving financial workloads and compliance obligations.

Solution

Cygnet.One partnered closely with HDFC to design and build a future-ready cloud infrastructure on AWS, one that matched the organization’s operational requirements, regulatory obligations, and long-term growth strategy. The collaboration began with a detailed discovery and planning phase, during which both teams jointly assessed the existing workloads, identified areas for cost control, and created a migration roadmap that prioritized system uptime, data reliability, and consistent performance.

To modernize the core database layer, HDFC’s MSSQL workloads were transitioned to self-managed PostgreSQL on Amazon EC2, offering better control over tuning parameters, performance optimization, and cost predictability. Tools such as sqlserver2pgsql, pgloader, and AWS Database Migration Service (DMS) were used for schema translation and real-time data replication. Given the presence of complex stored procedures and functions, Cygnet engineers rewrote them manually using PL/pgSQL, ensuring that the logic remained consistent and compatible with PostgreSQL standards. The live cutover process was managed carefully to ensure zero downtime, with all production data continuously synchronized throughout the transition.

On the storage side, HDFC implemented Amazon EFS to provide scalable shared access across workloads and transitioned to Amazon S3 for object storage, applying S3 Lifecycle Policies to automatically remove aged logs after 180 days. This decision resulted in a 50% reduction in long-term storage costs, while continuing to meet all compliance and audit requirements for data retention and traceability.

Cygnet also developed and validated a comprehensive disaster recovery (DR) plan, using AWS Backup to automate snapshot creation for both EBS and EFS volumes. The strategy was tested through structured business continuity and disaster recovery (BCDR) exercises, confirming that critical assets could be restored quickly, in line with defined RTO and RPO objectives, and with minimal disruption to ongoing operations.

To improve observability, an integrated monitoring stack was deployed using Amazon CloudWatch, OpenSearch, and Grafana, giving HDFC a unified view of system activity, performance metrics, and live logs. This centralized platform enabled operational teams to track anomalies in real time, generate automated alerts, and address issues proactively. As a result, the reliance on manual monitoring tasks was reduced and overall system resilience was strengthened.

Throughout the environment, security and compliance controls were built into every layer. IAM policies governed access permissions, data-at-rest encryption was enforced through SSE-S3 and EBS volume encryption, and audit trails were captured using AWS CloudTrail and AWS Config. These measures aligned with HDFC’s internal governance standards and helped the institution maintain strict regulatory compliance.

With the infrastructure now automated, modernized, and adaptable, HDFC is prepared to scale its services, respond effectively to future workload demands, and maintain the confidence of its customers, partners, and regulators by operating on a secure and predictable cloud foundation.

Tools & Technologies Used

AWS Glue

Managed ETL orchestration

AWS Lambda

Event-driven data triggers

Amazon Redshift

Centralized data warehouse

Power BI

Interactive dashboards and reporting

AWS S3

Storage for raw and processed data

Python & SQL

For data modeling and transformation