E-invoicing has achieved a global reach across various countries, including GCC countries such as KSA, UAE, and Bahrain. By July 2026, e-invoicing UAE will be live for businesses.

The UAE authority has disclosed its plan to implement e-invoicing, initially focusing on B2B invoice process UAE and B2G transactions, and later expanding it to B2C (business-to-customer) Transactions.

E-invoicing compliance UAE has gained momentum due to its focus on digitization and paperless transactions. The other wider benefits of e-invoicing are VAT compliance transparency, reduced tax leakage, simplified compliance workflow, automated invoice processing and tax filing, and more.

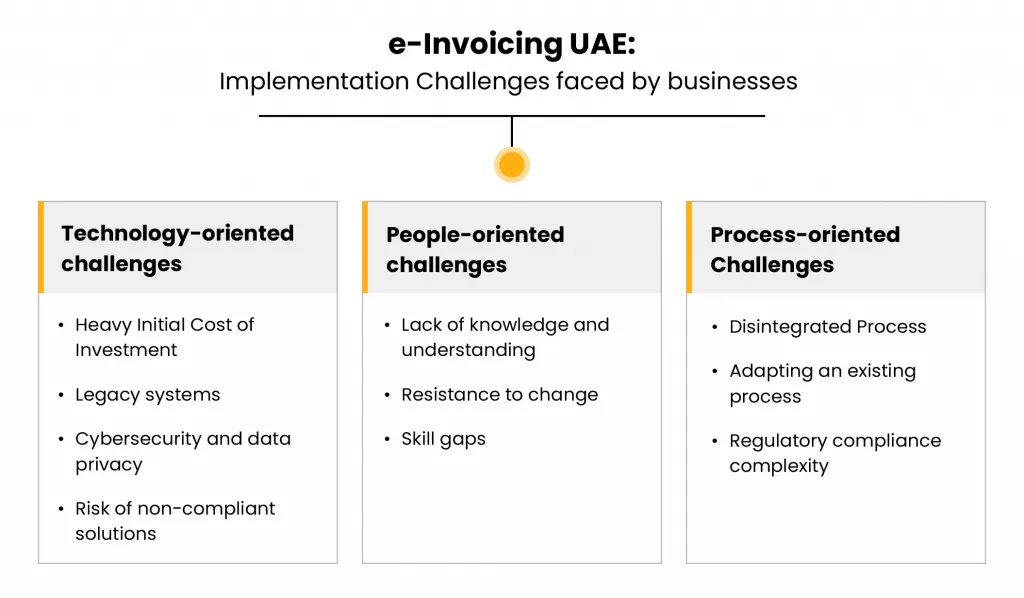

While UAE e-invoicing implementation has wide benefits, it comes with challenges, particularly at the initial stage of implementation. In this blog, we shall discuss those challenges, how they can impact businesses, and their possible solutions.

E-invoicing UAE: Implementation Challenges faced by businesses

Let’s categorize the challenges into three categories:

- Technology-oriented challenges.

- People-oriented challenges

- Process-oriented challenges

Technology-oriented challenges

Heavy Initial Cost of Investment

Businesses in the UAE have to comply with the PEPPOL-PINT format with the 5-corner model, where invoices will be transferred through the PEPPOL network. Companies have to partner with, PEPPOL Service providers (ASPs) accredited with MOF, facilitating e-invoicing compliance requirements.

Secondly, companies have to ensure their infrastructure is upgraded as per the UAE’s e-invoicing compliance requirements and business workflow. All this requires a heavy initial investment, straining their financial stability.

Legacy systems

UAE is implementing digitization in its tax administration and business workflow to ensure businesses start shifting to tech-driven systems and processes to ensure transparency and accuracy.

Most of the businesses are likely to have legacy or outdated systems, manual processing, human-driven, and time-consuming, which are incompatible with the current UAE’s e-invoicing requirements, non-integration with FTA, PEPPOL access points, and e-invoicing solutions, no real-time invoice validation or reporting, etc

Businesses will need to update their outdated systems or even retire and buy new infrastructure to ensure compliance.

Cybersecurity and data privacy

Cyberattacks are a major concern for the UAE. Phishing and compromised credentials remained major causes of the breaches, with companies in Saudi Arabia and the UAE losing around $194 per stolen or lost record.

Since the new e-invoicing requirement is more digitized, tech-driven, and automated, it is vital for businesses to ensure that all their infrastructure and process workflows are safe and secure; otherwise, businesses can lose their sensitive business information, affecting their financial health, market competitiveness, and reputation.

Risk of non-compliant solutions

As stated, businesses have to partner with an ASP to comply with their e-invoicing requirement. However, the main struggle is the selection of a suitable ASP and ideal e-invoicing solution that facilitates UAE’s e-invoicing requirements, specific business needs, security, cloud-based, scalable, and other such benefits at an effective cost.

While cost is a vital aspect, it cannot be the priority, as at times, cost-effectiveness cannot be compliance-effective. Therefore, businesses have to be careful while selecting their ASP and e-invoicing solutions.

People-oriented challenges

Lack of knowledge and understanding

E-invoicing is new for UAE businesses, and the tax and accounts team may lack the required knowledge and understanding of what processes need to be changed, how the new e-invoicing requirements will be implemented, and what additional features they will require in the e-invoicing software.

This can impact their evaluation on selecting the ideal ASP and e-invoicing solution, and how the new e-invoicing workflow would be implemented, making it challenging.

Resistance to change

Businesses would have their own established process for issuing and handling invoices. Staff accustomed to traditional paper-based or manual invoices may resist adopting the new e-invoicing process, particularly with an established workflow.

It slows down adoption, increases errors, delays compliance, and requires change management efforts to align teams.

Skill gaps

While integrating e-invoicing software and partnering with ASP is essential. It will be challenging if the IT team lacks the proper skills for the evaluation of existing business processes and infrastructure, and upgrading ERP/POC and integrating with the FTA portal or invoicing software.

Employees being unfamiliar with the new system, workflow, e-invoicing software UAE, invoice creation and validation, real-time invoice reporting requirements, and storage requirements can lead to errors and penalties in compliance with FTA e-invoicing requirements.

Process-oriented Challenges

Disintegrated Process

Businesses currently have a disintegrated process, decentralized documentation, and non-alignment among departments, such as finance, accounts, and tax, which can be challenging. It lacks visibility of real-time invoice synchronization, invoice status and reporting.

Disintegrated processes lead to data mismatches, delays in invoice transmission, reporting errors, and delayed payments.

Further e-invoicing solution is required to be integrated with VAT to ensure VAT return data is in sync with e-invoicing data and various reconciliations for credit claim or refunds are in alignment with e-invoicing.

Adapting an existing process

Businesses must hold existing invoicing workflows to align with e-invoicing requirements, such as real-time invoice generation, validation via ASPs, and tax data reporting to the FTA.

This involves redefining steps like invoice creation, approval, and storage to support structured formats (XML/JSON) and real-time connectivity with the Peppol network. For businesses accustomed to paper-based or PDF invoicing, this transition disrupts established procedures.

This impacts the operation workflow temporarily, such as delays in invoicing or payment cycles, and requires significant time to redesign and test new processes.

Regulatory compliance complexity

The FTA’s e-invoicing framework imposes strict requirements, including specific invoice fields (per the FTA’s data dictionary), real-time tax reporting, and a 10-year data retention period.

Businesses must ensure every invoice complies with PINT AE standards and is validated through ASPs. The phased rollout and evolving regulations add uncertainty, especially for firms operating across jurisdictions with varying e-invoicing rules.

E-invoicing UAE: Mitigation of challenges

Technology-oriented challenges

- Evaluate existing infrastructure, systems, and technologies, upgrade or retire as per current FTA e-invoicing requirements.

- Evaluate all suitable, experienced ASPs in the market and their feature to select the best suited for specific business requirements.

- Invest in cybersecurity and data privacy to ensure e-invoicing software has all government-required certifications and security.

- Explore a cloud-based e-invoicing solution to get scalability and flexibility as per the fluctuating needs of businesses.

People-oriented challenges

- Conduct awareness campaigns using MoF and FTA resources.

- Invest in targeted training for finance, IT, and operations teams on Peppol standards and compliance.

- Include management to ensure employees understand the need for the e-invoicing mandate UAE and don’t resist or fear job security or technology.

- Ensure ASPs or e-invoicing software providers conduct training sessions and demos for the upgraded e-invoicing process and system.

Process-oriented challenges

- Conduct process audits to identify silos and implement integrated software solutions.

- Form cross-functional teams to align workflows across departments.

- Map current workflows against e-invoicing requirements and roll out changes incrementally. Test new processes during the December 2025 pilot phase to minimize disruptions.

- Understand each e-invoicing requirement to align it with the e-invoicing workflow. Include tech partners to define ideal e-invoicing workflows.

- Make sure e-invoicing workflows are integrated with VAT solutions to ensure end-to-end automated data flow and reconciliation aligning VAT return data with e-invoicing data.

While these are ideations on challenges likely to impact during e-invoicing implementation. Many challenges would vary or come across during actual implementation based on specific business requirements.

Businesses have to start planning and executing their e-invoicing system and workflow requirements well in advance to ensure smooth operations and avoid disruptions or last-minute errors before the actual deadline.

How Cygnet can help the implementation of e-invoicing UAE

Cygnet, a Peppol-accredited service provider, supports UAE businesses in achieving e-invoicing compliance by offering an automated, end-to-end e-invoicing solution tailored to the UAE’s Decentralized CTC and Exchange Model (DCTCE) and PINT AE standards.

Its platform streamlines invoice generation, validation, and real-time tax data reporting to the FTA through seamless integration with ERP systems and the Peppol network, reducing errors and ensuring compliance.

Further, Cygnet also provide VAT solution which can carter all VAT compliance requirement as well as easily integrated with e-invoicing solution to ensure end-to-end automation in data flow, automated reconciliations, and alignment of e-invoicing data with VAT return data facilitating single source of truth for indirect tax compliance.

With proven expertise in Saudi Arabia, India, and other regions, Cygnet simplifies workflows, enhances efficiency, and supports cross-border transactions, enabling businesses to meet the July 2026 mandate while optimizing costs and transparency.

Conclusion

Implementing e-invoicing in the UAE by July 2026 presents significant opportunities for businesses to enhance VAT compliance, streamline workflows, and reduce costs through automation, but it also comes with substantial challenges across technology, people, and process domains.

From upgrading legacy systems and ensuring cybersecurity to overcoming skill gaps and adapting disintegrated processes, businesses must navigate these hurdles to meet the FTA’s stringent requirements, including real-time invoice reporting and PINT AE standards.

By proactively conducting process audits, investing in training, partnering with accredited service providers like Cygnet, and leveraging the December 2025 pilot phase, businesses can mitigate these challenges, ensure compliance, and unlock the long-term benefits of a digitized, transparent invoicing ecosystem.