Article first covered by Financial Express

DIGITALISATION OF INDIA’S financial sector began in the early 90s when automated teller machines (ATM) and electronic fund transfers (EFT) were introduced. Subsequently, internet banking was approved in India, followed by the National Electronic Fund Transfer (NEFT), Real-Time Gross Settlement (RTGS), Immediate Payment System (IMPS), etc.

In 2017, GST was introduced with an ancillary motive of formalising the economy. In recent times, India has started adapting to the Unified Payments Interface system. Very soon, the B2C invoicing for businesses with a turnover of more than Rs 500 crore will have dynamic QR codes for customers to pay at a click of a button directly.

Long story short, digital transformation is sweeping boldly across the economy, taking us from “going digital” to “being digital”. Cygnet Infotech is doing its bit in helping businesses on their digital journey. Its solutions approach digital transformation holistically; they are simple, fast and future-proof. “We have been able to assist our clients leverage hyperautomation and enhance their business operations through digital transformation,” says Niraj Hutheesing, founder & managing director, Cygnet Infotech.

“While working with the largest clients in India and globally, we empower their businesses with technology-led solutions and support them to run their business processes smoothly and efficiently. Even during the pandemic, we were able to retain clients and added several new clients.”

In the past year, the company grew more than 12% and was able to successfully onboard 250+ employees. Its offerings range from IT services, technology products, and tax technology solutions. Cygnet Infotech’s tax compliance management solutions help businesses build, automate, and modernise tax tech architecture and streamline global tax compliance processes. This allows companies to manage their invoices without errors and supports tax data analysis, audit assessment, vendor digitisation, tax compliance tracking, and establish a systematic & modern legacy system.

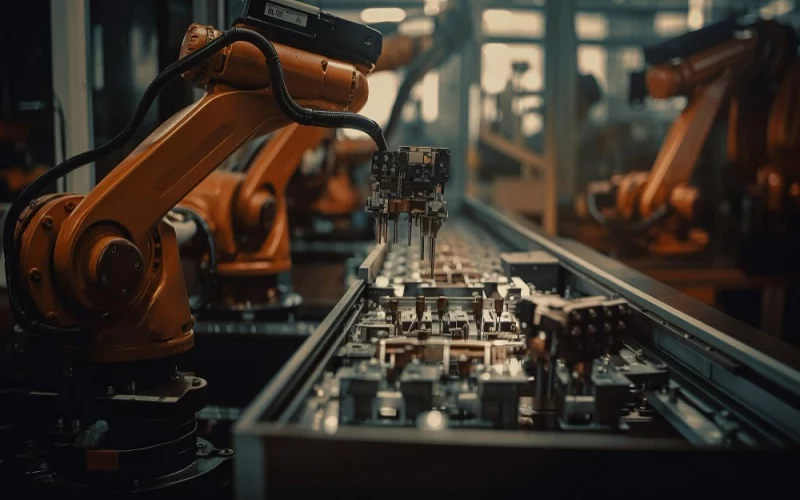

The company also provides solutions such as digital transformation, product engineering, robotic process automation, test automation, digital e-signing solutions, and more since its inception.

“Not only IT services but Cygnet Infotech’s product Cygnature, a blockchain-based digital e-signing solution also saw a strong adoption across industries as the usage of e-signatures increased,” says Hutheesing. “Some companies that were still hesitant to use e-signatures started mapping their used cases and selecting online signing solutions to make their business processes work smoothly. Many industries like pharmaceuticals, manufacturing, banking, etc. were able to ensure their document compliances are handled online through such electronic signing solutions,” he adds.

Cygnet Infotech’s Cygnature provides strong data privacy. There is robust encryption, secure data transmission, the ability to identify the signer, link the signer to the document, capture an irrefutable audit trail, blockchain, and protect the paper to protect tampering in the software. E-signatures ensure more secure, fraud-proof, and convenient than wet ink signatures.

Almost two-decade-old now, this fast-growing firm has clients across 35 countries, works with Fortune 500 enterprise corporations, medium-sized businesses, fast-paced startups, and government organisations.

As the company enters its 21st year, Cygnet Infotech has rejuvenated its logo, refreshed its brand fundamentals like brand promise and purpose, structured its sub-brands and endorsed brands. This exercise aimed to ensure that the brand remains most relevant to all Cygnet Infotech stakeholders, including clients, partners, current and future employees, and others.

“The organisation will continue to build a region-centric and portfolio-centric strategy to meet new market opportunities in the years ahead,” the company founder summarises.