Reduction in Failed Collections

Personalized Interaction Success Rate

Increase in Data-Driven Decisions Over 12 Months

Customer Records Processed

Overview

A national insurance provider was grappling with inconsistent premium collections and limited success in upselling policy upgrades. Traditional models lacked the depth to segment customers effectively, leading to impersonal outreach and missed revenue opportunities. With a growing base of over one million customers, the organization needed a smarter, scalable solution to drive collections and engagement. To address this, they worked with Cygnet.One to build an ML-based customer segmentation engine using AWS services. This initiative automated customer clustering introduced personalization strategies, and equipped business users with clear insights—all of which led to improved financial outcomes and operational efficiency.

The Business Need

With over a million customers and multiple insurance product lines, the client needed a strategy that could personalize communication while ensuring operational scale. However, manual processes and outdated segmentation methods stood in the way of precision targeting.

The key challenges included:

- High rate of failed premium collections affecting revenue stability

- Limited insight into upsells readiness across existing policyholders

- Need to process over a million customer records for reliable segmentation

- Lack of personalization in customer outreach strategies

To address this, the company set out to implement a data-driven segmentation engine that could support intelligent targeting and better revenue recovery outcomes.

Building a Targeted Segmentation Engine Using AWS

To modernize segmentation, Cygnet.One built a clustering engine using AWS-native services. The initiative began with ingesting and cleaning over 12 months of customer and payment history, ensuring the quality of data inputs for modeling. Amazon S3 and AWS Glue supported high-volume processing of structured and unstructured datasets.

Next, the team engineered behavioral and demographic features, transforming them into ML-ready signals. This included payment consistency, engagement rates, and policy lifecycle data. Traditional clustering models were applied to identify patterns in customer behavior and segment users into risk and opportunity groups.

From there, tailored messaging strategies were created for each segment. High-risk customers received personalized reminders and flexible payment plans, while high-potential customers were targeted with upsell offers based on engagement history. Results were shared via Power BI dashboards for performance tracking.

A feedback loop allowed the system to refine clusters over time, improving model accuracy and supporting dynamic adjustments to targeting strategies.

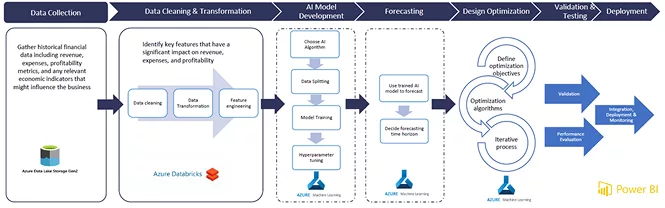

Architecture Diagram:

Driving Real Business Value with ML-Powered Segmentation

The ML segmentation engine helped the insurer significantly reduce failed collections by personalizing recovery efforts for each customer group. Business teams were able to act faster, respond more accurately, and minimize friction in payment recovery.

Uplift was also seen in upsell interactions—targeted campaigns saw an 85% success rate, helping increase policy upgrades and revenue per customer. With every customer placed into a behavior-aligned cluster, personalization was no longer a guessing game.

The system also enabled faster, more informed decision-making across the organization. Over 12 months, teams improved data-driven actions by 63%, strengthening their ability to engage the right customers at the right time. The segmentation engine now serves as a foundation for future ML projects, including churn modeling and lifetime value forecasting.

Tools & Technologies Used

AWS Glue

Data ingestion and processing

Amazon S3

Scalable data storage

Amazon SageMaker

ML model training and clustering

Power BI

Real-time reporting and dashboards

Flask

Lightweight API delivery

Python & SQL

Feature engineering and model orchestration

About the Client

The client is a national insurance services company offering a wide range of life, health, and general insurance products. With a strong focus on modernization, the firm continues to invest in digital transformation to improve customer engagement, collections, and profitability.