Digitalizing Tech in the Insurance Industry

An insurance market leader in South Africa digitally transformed the overall business with BI and AI-enabled insurance product management and improved the scalability of operational processes. This action helped them improve onboarding time by 50%. As their strategic IT partner, Cygnet.One offered best practices to improve their end-to-end digital ecosystem. Through our consultative approach, we discovered and implemented a newer and better CRM and migrated from a monolithic to a microservices architecture to replace the slower development speed of the monolith. With Cygnet’s contributions, the development efforts are saved by 20%

Download Success Story for future reference

Transforming manual operations into digital processes

The reduction in onboarding time brings a few challenges for the company. TU had a CRM built with legacy technology and an architecture that was novice in managing the database of 10 million customers. As a result, manual efforts and time consumption increased, resulting in a decline in average insurance sales. Additionally, the efforts put into non-scalable systems were mostly in vain. The key challenges TU faced:

- Numerous manual, paper-based procedures were in place, such as the claims process for insurance coverage, leading to errors and delays due to manual handling.

- The presence of non-scalable systems required resolution to support future business expansion.

- The company’s growth potential was constrained, necessitating an expansion strategy.

- Reducing dependence on personnel was a critical objective

Preparing for the future

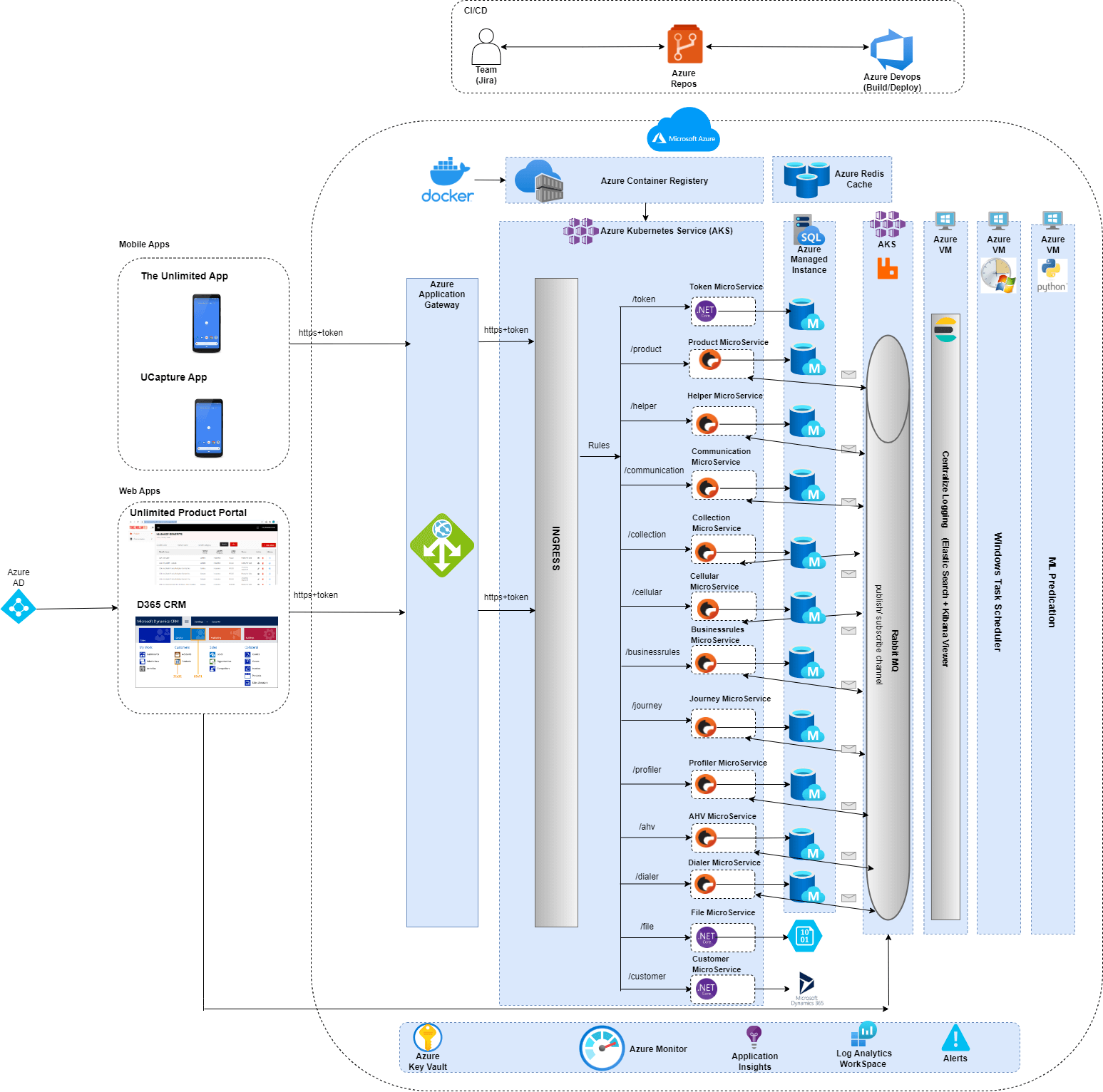

A team of technology leaders consulted the client to understand the challenges rightly. The first engagement step was a thorough evaluation of the business requirements and issues faced by the teams. Based on the findings of the evaluation, Cygnet’s experts recommended a new architecture and a CRM as a single solution that’d transform the organization digitally. Microservices architecture is an architectural method that relies on a series of independently deployable services. Utilizing this architecture makes the complexity visible and more manageable by separating tasks into smaller processes that function independently of each other and contribute to the overall whole. Additionally, this move to microservices hosted over the cloud, followed by DevOps, helped speed up the deployment process. Not only that, we used a low-code tool called Warewolf to keep the application development process incredibly simple yet powerful. Furthermore, the experts at Cygnet were able to digitize the insurance sales with the development of a mobile application for agents to capture policy details wherein customers were also able to claim insurance amount with all necessary approvals & payments effectively.

Benefits

Adopting microservices and cloud solutions streamlined development, reducing manual work and aligning with growth and scalability needs.

CRM and mobile app enhancements led to precise data capture, cutting errors, and improving claims processing

DevOps and digital solutions accelerated onboarding, supporting growth and expansion strategies effectively

User-friendly mobile apps attracted a larger customer base, supporting expansion and reducing personnel dependence.

Adopting microservices and cloud solutions streamlined development, reducing manual work and aligning with growth and scalability needs.

About the Client

Our client is a leading service provider in the insurance domain since 25+ years, that engages with multiple insurance companies by offering white label solutions/products to their customers in South Africa with a 750,000+ client base. For the past 28 years, they have quietly gone about the business of building a company that, at its very core, is shifting the lives of all those it touches, freeing people from limitations.