Introduction

E-invoicing is trending worldwide, showing how important it is to business workflow and tax administration systems to have transparency and accuracy in transactions. After understanding the need for and trend of e-invoicing, Malaysia also implemented e-invoicing on 1 August 2024.

This helps reduce tax evasion or increase transparency in transactions and provides faster processing by integrating automation into the process. Thus, the process becomes paperless and digitized, benefiting the entire ecosystem.

While there are many challenges at the initial implementation stage, there is much more to learn about e-invoicing’s benefits. This article will discuss the challenges and benefits of e-invoicing and best practices for e-invoicing compliance.

Challenges of e-invoicing

ERP Integration: Legacy systems hinder the integration of e-invoicing solutions or the MyInvois portal.

Legal Compliance: Lack of proper knowledge about e-invoice generation, transfer, and reporting may invite fines and penalties.

Bulk e-invoice generation: At the initial stage, there can be errors in huge data processing, which results in problems with data buffering for invoice processing, updating huge amounts of data accurately, etc.

Synchronization with IRBM portal: As e-invoicing requires real-time invoice reporting, accurate and efficient synchronization with the government portal can be problematic.

Security concerns: Compliance with the law will require electronic transfer of the invoice, which is prone to leakage of sensitive data.

Consolidated e-invoicing: When buyers do not require e-invoices, a consolidated e-invoice for an aggregate of buyers’ transactions is issued and reported to IRBM. Having this facility working with accuracy is vital for businesses to ensure compliance with the law.

Even though businesses face many challenges at the initial stage of e-invoicing implementation, its benefits are much more helpful for ensuring the seamless running of the process workflow. Let us look at some significant benefits of e-invoicing in Malaysia.

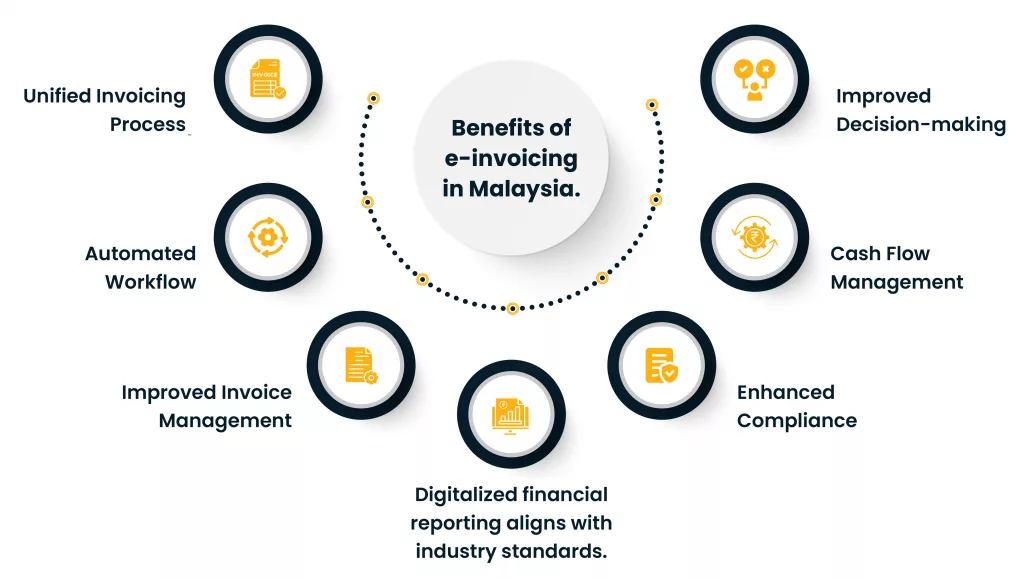

Benefits of e-invoicing in Malaysia

Unified Invoicing Process

IRBM requires all businesses to issue e-invoices in the formats needed in mandatory and optional fields. This would maintain standardization and facilitate transmission among buyers, suppliers, and the government.

Automated workflow

E-invoicing enables automated workflow processes, from invoice generation to final processing, ensuring streamlined operations with minimal human intervention and validation by the government. This ensures reduced errors or discrepancies, enhanced efficiency, and savings in time and cost.

Improved invoice management

Businesses can set up automated reminders for overdue payments, improving collections and reducing delays. Further, it reduces errors associated with paper-based invoicing, such as transcription mistakes or lost documents.

Digitalized financial reporting aligns with industry standards

E-invoicing simplifies financial reporting by providing accurate and readily accessible invoice data. Digital invoices can be easily integrated into accounting systems, facilitating the seamless preparation of financial statements and enabling businesses to comply with reporting requirements more efficiently.

Enhanced Compliance

E-invoices can be automatically validated against tax regulations, reducing non-compliance risk and associated penalties. Additionally, e-invoicing provides an auditable trail of transactions, enhancing transparency and accountability.

Cash Flow Management

E-invoicing helps businesses maintain a healthier cash flow by accelerating the invoicing and payment. Faster invoice delivery and payment processing enable businesses to receive payments more promptly, reducing the time between invoicing and receipt of funds.

Improved decision-making

E-invoicing gives businesses real-time access to invoice data. It provides insights into cash flow, revenue, and expenses, enabling more effective, informed decision-making, optimizing resource allocation, and maximizing profitability.

Best practices for e-invoicing compliance

- Check the e-invoicing implementation timeline and identify the phase in which your business falls.

- Understand e-invoicing models and decide the best-suited model per your business requirements.

- Check your current systems and technology and identify whether it meets Malaysia e-invoicing requirements.

- Update technologies in case legacy technologies.

- In case of direct reporting to the MyInvois portal, line out the requirements and files to be maintained for easy reporting.

- If you use third-party services, select the right solution provider by examining all the criteria according to your requirements, including self-billed and consolidated e-invoicing and other services.

- Implement e-invoicing methods and review regularly to identify errors or deficiencies.

- Improve the process and methods on a timely basis for seamless processing.

Why Cygnet?

Cygnet provides a comprehensive e-invoicing solution for regular e-invoice, self-billed e-invoicing, and consolidated e-invoicing transactions tailored to the Malaysian market. It integrates with leading ERP systems, including SAP, Oracle, Tally, Microsoft, other accounting systems, POS, CMS, and retailer web portals. It offers e-invoice management alongside multiple data validations and compliance at every step of the invoicing process. Our platform boasts high reliability, availability, integrity, scalability, etc.

Cygnet caters to your specific needs, whether you prefer cloud-based or on-premise solutions. We provide robust role-based access management to ensure security. All this can be done without hindering invoicing processing efficiency, accuracy, and transparency. With a team of legal and technology experts, we provide 24*7 support for your e-invoicing compliance and glitches.

Beyond e-invoicing, Cygnet also provides other services required for businesses’ efficient workflow. Cygnet facilitates purchase and payment automation by automated extraction of data, verification of data, easing accounts payable, integrating counterparty invoice APIs with ERP to have automated purchase data entry to reduce invoice mismatch with vendors, Vendor post box to manage various documents, and providing 3-way reconciliation, simplified approval workflow, and automated payment file generation, etc. to ensure accuracy and efficiency across the process.

Apart from this, Cygnet provides various offerings for hassle-free government notice handling, Indirect Tax compliance, Vendor onboarding, etc, to provide a one-stop solution for all your business and compliance needs.

Looking Forward

In conclusion, embracing Malaysia’s e-invoicing system presents a pivotal opportunity for businesses to streamline processes, enhance efficiency, and contribute to a digitally driven economy. By adhering to the standards set forth by the Malaysian authority and leveraging technologies, businesses can seamlessly transition to e-invoicing, realizing benefits such as reduced operational costs, enhanced workflow, improved decision-making and financial reporting, faster payment cycles, improved accuracy and compliance with regulatory requirements.