Introduction

In this ever-evolving landscape of modern business, procurement stands vital and requires efficiency and strategic planning. Gone are the days of simple transactions; today, procurement practices encompass a complex network of relationships, technologies, and methodologies to optimize every aspect of the supply chain.

From sourcing raw materials to managing supplier relationships, modern procurement transcends mere acquisition to become a strategic function that drives innovation, mitigates risk, and ultimately enhances organizational performance.

In this dynamic environment, businesses must adapt to emerging trends, embrace technological advancements, and cultivate collaborative partnerships to stay ahead. The source-to-pay automation lies in its ability to revolutionize traditional procurement processes, streamlining operations from initial sourcing to final payment.

Leveraging advanced technologies such as artificial intelligence, machine learning, and robotic process automation can help organizations automate routine tasks, improve accuracy, and reduce cycle times. Welcome to the modern automation world, where agility, transparency, and sustainability reign supreme.

What is Source-to-Pay (S2P) Automation?

Source-to-pay is a business process with all the activities related to the procurement of goods or services, from identifying potential vendors, bidding, negotiating contracts, and evaluating the required need of procurement to making the final payment on procured products or services. When the entire process is automated, requiring minimal human intervention and reduced errors, it is said to be source-to-pay automation.

Source-to-pay automation provides all businesses with a single platform to contact all potential vendors or suppliers and bring external and internal activities under one roof.

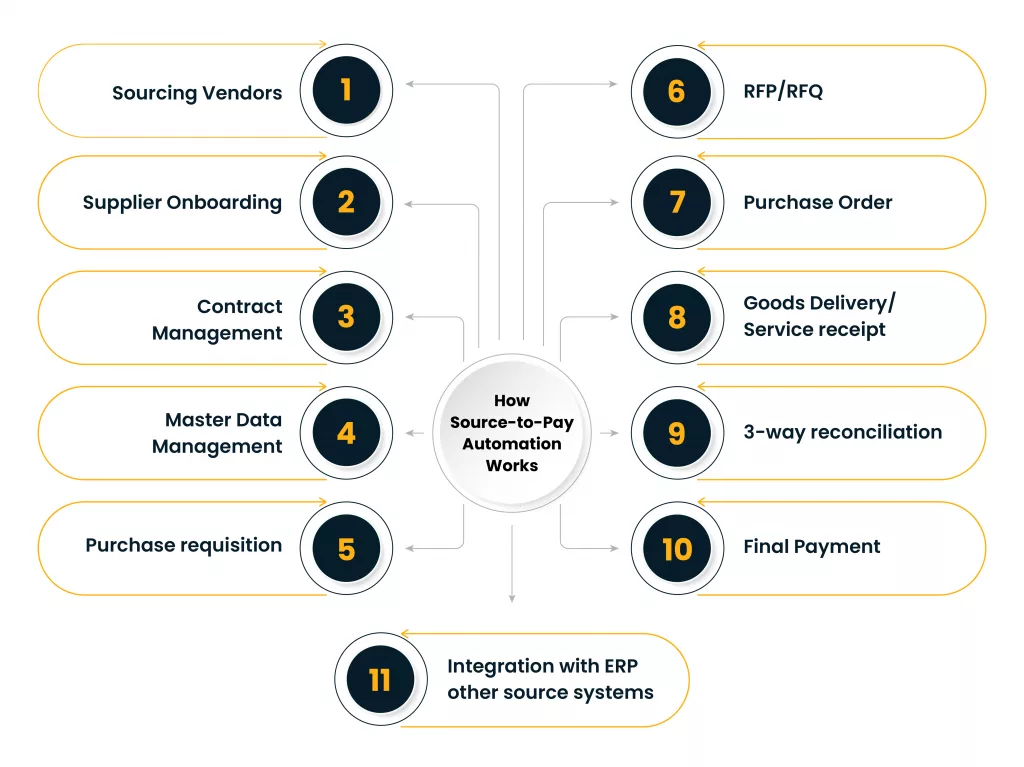

How Source-to-Pay Automation Works

Sourcing Vendors: This initial and most crucial step involves identifying potential suppliers to meet the company’s requirements. Suppliers are evaluated and shortlisted based on predefined criteria in an automated source-to-pay (S2P) system. Suppliers meeting the company’s predefined standards and criteria are then onboarded, ensuring alignment with the company’s norms and logic.

Supplier Onboarding: After a vendor is sourced, onboarding becomes crucial for integrating the supplier into the S2P process. Beginning with supplier verification and registration, S2P ensures smooth onboarding. While onboarding a vendor, thorough verification of the vendor’s background check, creditworthiness, market reputation, GST compliance status, PAN verification, identity verification, bank account verification, etc, is carried out with automation to ensure speedy and accurate verification and registration of vendor for onboarding.

Contract Management: Once suitable suppliers are sourced, negotiations are conducted to establish contract terms, including pricing and quantities of goods, negotiation of terms and prices, contract period, termination clause, penalty clause, discounts, premium charges, non-negotiable clause, etc. S2P provides standard as well as customized contracts prepared based on pre-defined conditions and criteria.

This automated process helps reach a consensus on standardized terms that benefit both parties. Contracts can be efficiently prepared, digitally signed by all parties, and stored in a centralized location for easy access. This streamlined approach ensures clarity, efficiency, and effective management of contractual agreements.

Master Data Management: The vendor records collected during onboarding are validated, stored, and integrated into the system, becoming the single source of truth for supplier details, pricing, products, and contract terms. Master data management ensures consistent, accurate, and centralized data of suppliers, contract terms and conditions, prices, products, etc., providing insight from sourcing to procurement and final payment, minimizing discrepancies, improving procurement accuracy, and enhancing reporting, decision-making, and regulatory requirements.

Purchase requisition: The purchase requisition initiated by the department has clear details about the product required, quantity, delivery requirements, etc., to help you understand the exact procurement needs. PRs, once generated, are automatically sent for approval to assigned personnel to ensure the demand is aligned with the budget and the company’s operational needs. Automated S2P systems may flag PRs that exceed budget thresholds, providing an extra layer of cost control. The S2P process automatically understands clear specifications, identifies suitable suppliers, and initiates an RFP or RFQ process.

RFP/RFQ: AutomatedS2P solution provides customized templates to createRFP (Request for Proposal) and RFQ (Request for Quotation), which have project details, deadlines, requirements, evaluation criteria, etc. Further, Master data management integration fetches appropriate supplier information, pricing histories, and contract terms, eliminates the need for repetitive data entry, and minimizes errors. It also includes conditional logic in RFPs/RFQs, prompting specific supplier responses or document uploads based on the nature of the purchase or regulatory requirements.

Once created, the RFP or RFQ can be automatically distributed to pre-approved suppliers via the S2P platform and notified through mail portal access or mobile alerts, providing timely reminders to meet submission deadlines. An automated S2P module can help compare all RFP/RFQs and provide AI-powered insights to evaluate pricing, terms, qualitative aspects, delivery time, etc., to suggest the best supplier match.

Purchase Order: Upon approval of the quotation, a purchase order is automatically generated within the system and sent for approval to the relevant stakeholders. Once approved, the purchase order is automatically transmitted to the supplier. The purchase order contains detailed information such as item descriptions, quantities, prices, and shipping instructions in case of goods, type of services, value of services, etc. in case of services.

Based on this purchase order, the supplier initiates issuing an invoice and delivering the goods or providing services. This automated workflow ensures efficiency and accuracy in the procurement process, reducing manual intervention and streamlining communication between the buyer and the supplier.

Goods Delivery/ Service receipt: Upon delivery of goods, the team physically verifies the quantity and quality of the goods and services, respectively, and their value, creating a Goods Receipt logged in the system as confirmation of accurate fulfillment. This record is crucial for three-way reconciliation, which compares the PO, Goods Receipt, Supplier Invoice, and e-way bill to authorize payment.

3-way reconciliation: In an automated Source-to-Pay process, three-way reconciliation is a validation step that ensures accurate, compliant transactions by comparing essential documents such as PO, GRN/SRN, Supplier e-invoice, and even e-way bill/transportation receipt. In case of any error or discrepancies, the S2P module flags the same. It sends an alert to the team after using predefined tolerance thresholds for minor variances that allow for auto-approval when within set limits to prevent incorrect payment and ensure compliance.

Final Payment: After thoroughly reconciling all pertinent documents and verifying the purchase reflected in GSTR-2A/2B, payments are automatically released upon approval from relevant stakeholders, if necessary. The status of the payment is promptly communicated to the vendor. Automation guarantees timely and precise payments for every purchase, ensuring efficiency and accuracy in the payment process.

Integration with ERP/other source systems: S2P automation seamlessly integrates with ERP and accounting systems, automating data flow among procurements, accounts, and finance. Upon approval by the necessary stakeholder, it triggers automatic data entry into ERP or accounting software, eliminating the need for manual intervention. This synchronizes purchase orders, GRN/SRN, invoices, accounting entries, and payment data, minimizing errors and maximizing efficiency without manual intervention.

Benefits of Source-to-Pay Automation

Reduction in payment cycle – Automated Source-to-Pay processes streamline the end-to-end procurement workflow, significantly reducing the payment cycle. Automation completes repetitive tasks like purchase order creation, approval routing, and reconciliation much faster than manual processes. For example, once the goods are received and verified, all relevant documents, like e-invoice, GSTR-2A/2B, etc., are auto-reconciled, triggering payment approvals within minutes. This reduces delays, ensures suppliers are paid faster, and strengthens supplier relationships by honoring prompt payments, which can also lead to early payment discounts and improved cash flow management.

Supplier Management – S2P automation fosters strong supplier relationships, driving growth, sustainability, and cost reduction. Automation tools monitor KPIs, ensuring timely delivery, quality, and contract compliance. Leveraging S2P automation optimizes vendor relationships, minimizes supply chain disruptions, and boosts operational efficiency and profitability.

Compliance and Security – Procurement automation ensures compliance with legal requirements and ethical guidelines by maintaining logs of contractual agreements and monitoring current contract compliance and related risk, thereby mitigating penalties. It employs encryption for data security and comprehensive audit trails for transparency and compliance documentation to adhere to regulatory standards and build trust among stakeholders.

Leveraging Analytics for Informed Decision-making – S2P automation provides real-time reporting and analysis, offering insights into supplier performance, supply chain, operating cycle, and expenses, identifying improvement areas, and mitigating risks. Automated alerts can flag deviations from established benchmarks, allowing proactive resolution.

Predictive analytics anticipates future procurement needs by analyzing historical data and market trends, optimizing inventory levels, and enhancing strategic planning.

Enhanced Accuracy – S2P automation minimizes human errors that often occur with manual data entry and document matching. Automated reconciliation cross-checks the purchase order, goods receipt, and supplier invoice at the line-item level, ensuring all details- quantity, price, and terms—are correct before payments are processed. This automated accuracy reduces overpayments, duplicate payments, and supplier disputes, resulting in fewer corrections and rework. S2P automation optimizes financial operations by enhancing speed and accuracy, providing more reliable, efficient, and cost-effective procurement and payment cycles.

Scalability – The scalability of S2P automation ensures seamless expansion and adaptation to evolving business needs, accommodating increased transaction volumes, additional users, and diverse procurement processes. With its flexible architecture and cloud-based solutions, S2P automation can effortlessly grow alongside the organization, delivering consistent performance and efficiency at any scale.

Efficiency Gains in Procurement Workflows – Automation optimizes sourcing, contract management, purchasing, and payment processes, enhancing productivity and cost savings. Real-time data insights and analytics enable informed decision-making, driving continuous improvement and operational excellence in procurement operations.

Cost Reductions and Financial Savings – By optimizing procurement processes, negotiating favorable terms with suppliers, and eliminating inefficiencies, organizations can achieve more significant economies of scale and leverage data insights to make informed decisions, resulting in reduced procurement costs and improved financial performance.

Single source of truth – S2P automation provides enhanced visibility and control over the entire procurement lifecycle, from sourcing to payment. By centralizing procurement data and providing real-time insights, organizations gain a comprehensive view of supplier relationships, spending patterns, and performance metrics. This visibility enables proactive decision-making, risk mitigation, and compliance enforcement, improving operational efficiency and strategic alignment.

Summary:

Unleashing the Full Potential of Your Procurement with Source-to-Pay Automation

Adopting source-to-pay automation represents a transformative step forward for businesses seeking to optimize their procurement processes. By harnessing the power of automation, organizations can unlock significant efficiency gains, cost savings, and strategic advantages throughout the procurement lifecycle. From streamlining sourcing and contract management to enhancing supplier relationships and mitigating risks, S2P automation offers a comprehensive solution to modernize and elevate procurement operations. As we move forward, it is clear that S2P automation will continue to play a pivotal role in driving innovation, agility, and value creation in the ever-evolving business landscape. Embracing this technology-driven approach is not just a choice but a necessity for businesses striving to thrive in today’s competitive marketplace.

Why Cygnet?

Cygnet’s Vendor Postbox automates and optimizes the Source-to-Pay process, improving efficiency across tax, finance, procurement, and accounts payable functions. This cohesive approach reduces costs and boosts efficiency by bridging tax, finance, and procurement teams into a unified workflow. Providing digital invoice receipt and processing ensures up to 99% reconciliation accuracy for ITC, effectively reducing costs and increasing cash flow visibility. The tool also includes robust vendor onboarding, pre-checks, and payment processes linked to GSTR 2B, offering real-time insights and streamlined compliance to maximize tax credits and workflow efficiency. The platform’s real-time insights and seamless automation cut costs, streamline processes, reduce payment cycles, and bolster compliance

Pertinent FAQs about Source-to-Pay Automation

Source-to-pay automation strengthens vendor relationships by improving communication, transparency, and efficiency, leading to smoother transactions and greater mutual trust and satisfaction.

Typical challenges during source-to-pay automation implementation include data integration complexities, resistance to change from stakeholders, and ensuring system compatibility with existing processes.

Yes, source-to-pay automation systems can adapt to changing compliance and regulatory requirements by allowing flexible configurations and updates to accommodate evolving regulations, ensuring continued compliance throughout the procurement process.

Employees typically require basic to intermediate training to effectively utilize source-to-pay automation, focusing on system navigation, understanding workflow processes, and adherence to organizational policies and procedures.