Tax teams rarely get headlines. Until something goes wrong. A missed filing, unexpected adjustment during an audit, or a public dispute with a revenue authority can undo years of careful work in a single quarter — challenges that often surface when enterprises lack structured indirect tax governance practices.

When that happens, the question from the board is simple: “Did we have our taxes under control, or were we just reacting?” That is exactly the gap that strong tax governance is meant to close.

A mature governed tax framework does far more than simply keep your returns clean. It defines how tax decisions are made, who owns which risks, what information is trusted, and how evidence is captured for regulators, auditors, and management. For enterprise CFOs, tax leaders, and compliance heads, it becomes the bridge between daily tax operations and wider corporate governance.

In this blog, we will unpack the governed tax framework in a structured way so you can map it to your current reality, identify gaps, and design a path to a more reliable tax environment. The sequence is simple: definition, components, roles, technology, compliance, global standards, and finally a practical checklist you can use with your team.

What does a governed tax model really mean?

In an enterprise context, tax governance is the system of policies, processes, responsibilities, and controls that guide how an organization handles all its tax obligations and tax-related decisions, a foundation that strong tax assurance frameworks build upon to reduce risk and improve transparency.

It covers direct and indirect taxes, transfer pricing, withholding taxes, incentives, and disclosures across every jurisdiction where the business operates.

Instead of treating tax as a set of isolated filings, the governed tax model treats it as an integrated part of corporate governance. That means:

- Written tax strategy aligned with business objectives and risk appetite

- Clear roles for the board, audit committee, CFO, tax head, and business units

- Documented procedures for planning, reviewing, approving, and reporting tax positions

- Evidence of monitoring, testing, and remediation of tax issues over time

Each layer supports the next. If one layer is weak, the entire structure becomes fragile.

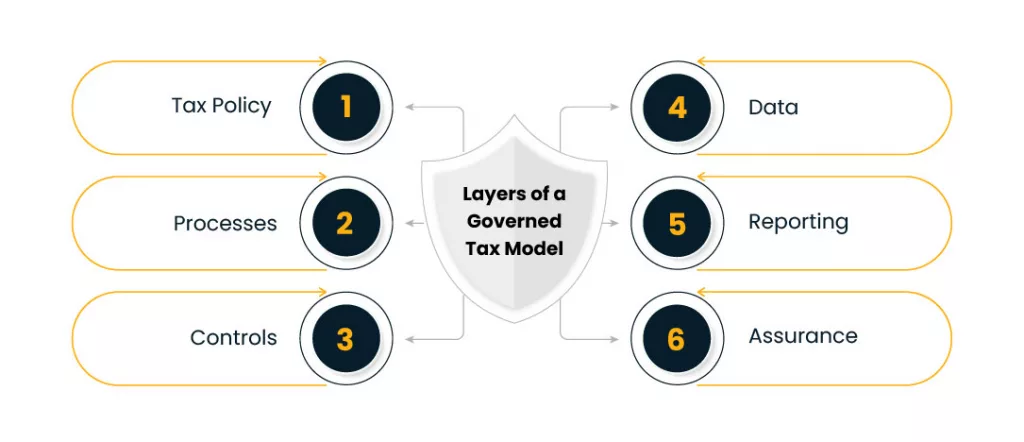

Core components of an enterprise tax governance framework

For most enterprises, the building blocks are similar, even if terminology differs. A practical tax governance design usually includes the following components.

1. Tax policy and strategy

- Written policy approved by the board or audit committee

- Clear statements on acceptable tax risk, use of incentives, and approach to tax planning

- Alignment with ESG, reputation goals, and stakeholder expectations

2. Documented processes

- Standard operating procedures for compliance, provision, transfer pricing, and controversy, increasingly supported by digital workflows and automated tax compliance environments.

- Workflow handoffs between tax, finance, legal, and business teams

- Timelines and dependencies for filings and payments

3. Defined roles and responsibilities

- RACI matrices for key activities such as returns, audits, and disclosures

- Designated tax owners for each entity and jurisdiction

- Escalation paths when judgment-heavy issues arise

4. Control environment

- Integrated tax control framework mapped to enterprise control standards

- Use of checklists, reconciliations, approvals, and signoffs

- Periodic control testing and remediation tracking

5. Data and systems

- Tax-sensitized chart of accounts and master data

- Standard data sources for indirect tax, payroll tax, and withholding

- System rules that reduce manual overrides and spreadsheet dependence

6. Monitoring, reporting, and assurance

- Dashboards for compliance status, open issues, and audit exposures

- Periodic reporting to leadership and the board

- Independent reviews by internal audit or external advisors

When these components are explicit, repeatable, and auditable, tax leaders can describe how the function runs with confidence, not just how it survived the last filing season.

Roles and ownership inside the governance model

Effective tax governance is not only the tax department’s concern. It is shared across the organization, because outcomes depend on decisions made in sales, procurement, HR, treasury, and legal.

A clear role model typically looks like this:

Board and audit committee

- Approve tax policy and risk appetite

- Receive regular reporting on key exposures, disputes, and control gaps

- Challenge management on judgment-heavy positions

CFO and executive leadership

- Sponsor the tax governance framework and ensure funding

- Integrate tax into finance, risk, and ESG agendas

- Approve material positions, disclosures, and settlements

Head of tax and tax leadership team

- Design and maintain the control framework for tax

- Own tax risk management across direct, indirect, and transfer pricing areas

- Define policies, procedures, and guidance for local teams

Business functions and local finance

- Execute day-to-day activities in line with policy

- Provide accurate data and documentation

- Flag unusual transactions or new business models early

Internal audit and compliance

- Test internal controls relevant to tax

- Validate remediations and report on systemic issues

- Benchmark practice against internal policies and external expectations

Where many enterprises struggle in the handoffs. Sales runs promotions with complex pricing, procurement signs unusual contracts, or HR introduces new incentive plans, and tax hears about it late. A working governance model introduces triggers, so tax is brought into the conversation at the right time, not after the fact.

Technology as the nervous system of tax governance

In many enterprises, the design of the framework is not the primary bottleneck. Execution is. Technology becomes the nervous system of tax governance, connecting policy, process, and data.

Key technology themes include:

Data integration and quality

- Connect ERP, billing, procurement, HR, and treasury systems

- Standardize tax-relevant fields and master data

- Automate checks that prevent common coding errors

Workflow and collaboration tools

- Structured request and approval flows for tax-sensitive decisions

- Shared workspaces for documentation, comments, and version control

- Automated reminders for filings, payments, and audit responses

Compliance and reporting engines

- Indirect tax engines or rules engines integrated with transaction systems

- Tools for computing provisions, deferred tax, and disclosures

- Country-specific e-invoicing and e-reporting connectors

Analytics and monitoring

- Exception reports on abnormal effective tax rates, unusual credits, or recurring errors

- Dashboards for aging of disputes and refund claims

- Trend views that reveal emerging risks before they turn into disputes

The stronger the link between these layers, the less the organization depends on heroics from a few tax experts and the more it relies on repeatable internal controls.

How does tax governance support day to day compliance?

Regulatory compliance remains the most visible outcome of tax governance. Returns must be filed, payments made, and disclosures completed on time, with positions that can withstand scrutiny.

A structured framework supports compliance in several ways:

- Each filing obligation is tied to an owner, a documented process, and a control

- Supporting documentation is prepared, reviewed, and stored in a consistent way

- It becomes easier to show regulators and auditors that the organization took reasonable care

For example, a coherent tax risk management approach might:

- Classify risks by likelihood and financial or reputational impact

- Link each high-risk area to specific controls in your wider control framework for tax

- Define how often each control is tested and who signs off on the results

This link between risk, control, and evidence is what often differentiates enterprises that manage disputes calmly from those that scramble whenever a notice arrives.

Global standards and expectations around governed tax models

Tax authorities and standard setters increasingly expect enterprises to explain how they manage tax, not just report the outcomes. Several reference points are useful when assessing your own framework:

- OECD guidelines on responsible business conduct and cooperative compliance

- Country-specific cooperative compliance or tax control regime programs

- Financial reporting requirements related to uncertain tax positions and disclosures

- Governance codes that reference board oversight of tax and ESG topics

Many jurisdictions now ask multinationals to describe their the governed tax framework in the context of risk-based programs or cooperative regimes. The message is consistent: enterprises should be able to show that tax decisions are embedded in their governance environment, supported by documented processes and controls, rather than informal judgments.

Even if your organization is not part of a formal regime, aligning with these expectations is useful. It improves readiness for cross border audits, supports ESG narratives, and gives boards better insight into how tax contributes to long term value and risk management.

Practical checklist: assessing your governance readiness

A framework is only useful if it leads to action. Use the following checklist with your tax, finance, and risk teams to assess where you stand today and what needs attention.

1. Strategy and policy

- Do we have a written tax policy approved at board or audit committee level

- Does it cover risk appetite, use of incentives, and approach to controversy

- Is it consistent with our ESG commitments and public statements

2. Organization and roles

- Are responsibilities documented for each material tax process

- Do business functions know when they must involve tax in decisions

- Are accountability and reporting lines clear for local entities and global oversight

3. Processes and the control framework for tax

- Do we have a documented tax control framework that maps controls to key risks

- Are procedures written, current, and accessible to the people doing the work

- Are there regular reviews to test control design and operating effectiveness

4. Data, systems, and documentation

- Are source systems configured to support accurate coding of transactions

- Is tax data reconciled to financial statements and external filings

- Is documentation complete, organized, and retrievable for audits or due diligence

5. Risk and assurance

- Do we maintain a consolidated view of tax exposures, disputes, and uncertain positions

- Is there a structured process for managing tax risk with defined owners and timelines

- Does internal audit periodically review tax processes as part of its plan

For many enterprises, the hardest step is simply writing down how things actually work today. Once reality is visible on a page, gaps become obvious and honest conversations about improvement get much easier.

Bringing it together

Strong tax governance is not about creating binders of policy. It is about giving your organization a consistent way to make tax decisions, record judgments, and demonstrate reasonable care to stakeholders who matter regulators, investors, employees, and customers.

As enterprises move through business model changes, new digital channels, and shifting regulations, the tax function that is guided by a thoughtful framework will always be in a better position. It can respond to new rules with structure rather than panic, support strategic initiatives with clear analysis, and give leadership a credible view of risk. The opportunity now is to treat the governed tax framework as a living part of your corporate governance agenda. Start by assessing where you stand using the checklist above, involve the right stakeholders, and then prioritize a handful of improvements that make the system more deliberate and less dependent on firefighting. Over time, this approach turns tax governance from a periodic anxiety into a governed business capability that leadership can rely on.