Introduction

As a transformative shift, authorities worldwide are understanding the impact of e-invoicing on the functioning of tax administration, including Malaysia’s IRBM. As the benefits of e-invoicing are not a secret anymore, neither for authorities nor for business organizations, it is equally crucial to understand and work on key prerequisites and assess an organization’s readiness for implementing e-invoicing in the business process.

This pre-requisite and readiness assessment involves legal and regulatory compliance, technical infrastructure, and comprehensive training. By addressing these pre-requisites, businesses can have a seamless transition to e-invoicing, adding operational efficiency and accuracy and fostering sustainable business workflow.

This article will take to the prerequisites for the implementation of e-invoicing.

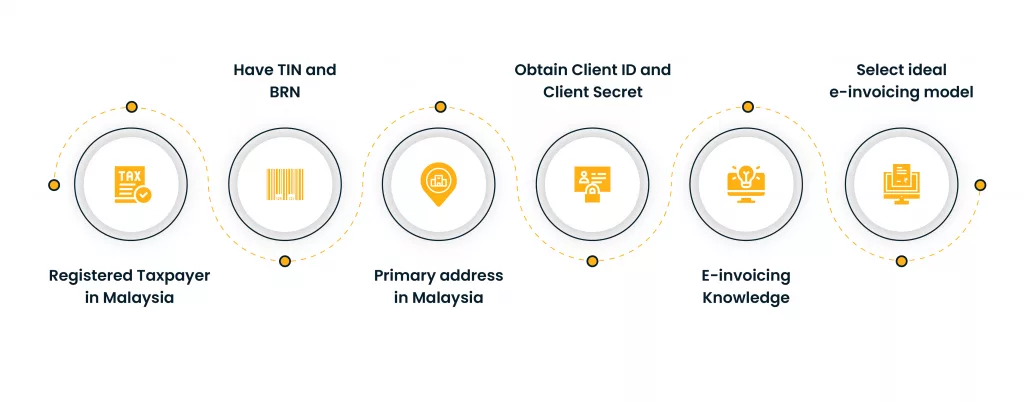

Prerequisites

- The company must be a registered taxpayer of Malaysia and have a TIN (Tax Identification Number) and BRN (Business Registration Number).

- The Primary address of the entity must be in Malaysia.

- Obtain a digital signature certificate from one of the Malaysian certificate authorities to digitally sign electronic invoices.

- Obtain Client ID and Client secret values to establish a secure integration with IRBM Portal.

- Have a comprehensive understanding of e-invoicing rules and regulations. To learn more about Malaysia’s e-invoicing in simplified form, visit our e-book “E-invoicing in Malaysia: A Complete Guide.”

- Decide about the approach to be considered for E-Invoice project implementation.

How do you get a Client ID and Client Secret?

- Registered taxpayers with TIN in Malaysia can obtain client IDs and Client Secrets.

- To obtain a Client ID and Client Secret, the business has to submit a request via email to sdkmyinvois@hasil.gov.my, with below information:

- Tax Identification Number (TIN) – excluding Employer’s (E) No.

- New Business Registration Number

- Company Name

- Company Email Address

- Name of ERP System

How do you acquire a Digital Signature?

- The digital signature has to be obtained by registered taxpayers from Certified and Recognized authorities only.

- A list of certified authorities can be found at this URL: https://www.mcmc.gov.my/en/sectors/digital-signature/list-of-licensees

- The user can apply to purchase a digital signature for an e-invoice with any of the above-listed agencies.

- Up on issuance, the Cygnet’s system must provide the same.

- Cygnet’s system will generate the signature value for every document generation.

The Approach of e-Invoicing Project

There are the following approaches:

- LHDNM Approach

- Integration through APIs

- Direct integration of ERP with LHDNM

- Integration through technology/e-invoice solution provider

- MDEC Approach (Peppol route)

Readiness Assessment for implementation of e-invoicing project

It is vital for businesses to be ready when the implementation deadlines hit to ensure a hassle-free start of the e-invoicing process. To ensure that, here are a few points to be considered:

- Evaluate the current process and IT capabilities for issuing documents like invoices, credit notes, debit notes, bills, etc.

- Determine the availability of IT infrastructure, data source, and structure to evaluate system readiness.

- Evaluate the best-fit e-invoicing model based on your business requirements.

- Select the ideal technology/e-invoice solution provider or PEPPOL-accredited service provider to ensure optimum compliance with minimum effort.

- Allocate and equip the organization’s personnel with proper e-invoicing facilities and required infrastructure to adopt and supervise e-invoicing implementation.

Looking Forward

While there is always room for discrepancy when the systems and solutions are in practical use, that does not mean an organization should not work on pre-requirements and ensure optimum readiness for the e-invoicing process. The rest of the minor issues and discrepancies can be tackled easily if organizations have in-house experts or suitable service providers. To be compliant ready, approach Cygnet’s e-invoicing for your businesses’ effortless and automated e-invoice workflow.