The government views ISD as a legacy mechanism from the service tax regime, refined under GST to facilitate credit distribution for large organizations with centralized billing.

The provisions of ISD in GST are almost similar to the erstwhile Cenvat credit rules, except for the fact that the services under RCM are covered in ISD in GST post 2024 amendment, which was not applicable in the service tax regime. Further, for ISD in GST, the monthly return in FORM GSTR-6 is required to be filed, while in service tax, a half-yearly return in FORM ST-3 is required to be filed.

The GST council aims to bring accuracy, align with digital reporting, and streamline GST compliance to avoid tax leakage and ensure long-term stability and equitable tax revenue distribution across the states. Mandating ISD in GST is one such move to enhance operational transparency and help taxpayers with different registrations under the same PAN distribute ITC of common services across the state in an accurate and appropriate manner.

In this blog, we shall explore a basic understanding of ISD, how it is essential for GST compliance efficiency, challenges faced in ISD implementation, and how technology facilitates ISD compliance efficiency.

Understanding ISD under GST

ISD means the office of the supplier of goods or services or both receiving a tax invoice for receipt of input services, including input services received under RCM for or on behalf of a distinct person (person having different GSTN registrations under the same PAN) and distributing common ITC in a manner as prescribed.

To summarize this

- ISD is a separate registrant apart from normal registration.

- Aims to distribute ITC (IGST, CGST, SGST/UTGST) of the common service among the branches/locations or units receiving such services.

- ISD shall not raise any taxable invoice; it can only raise an ISD invoice for the distribution of common ITC.

- ISD is not involved in the supply of goods or services or both, but only in receiving invoices of common input services and distributing credit, attributable to only units receiving such services under the same PAN.

Let’s understand this with an example. Suppose a company “X” (HO) located in Gujarat has three other units/branches named P, Q, and R located in Rajasthan, Madhya Pradesh, and Maharashtra, respectively. All of these units are availing AMC services for their software from a company named C.

Now, in this scenario, all of these units are eligible to avail of ITC. X, being HO, can take the ISD registration. C can issue an invoice to ISD X for the input service provided, and X (under ISD registration) can issue ISD invoices to X(under normal registration), P, Q, and R, and distribute the ITC of common services in the ratio of their turnover.

Now, if I say only X, P, and Q are receiving such AMC services from C, then the ISD invoice shall be issued by ISD X to only X (under normal registration), P, and Q, and ITC shall be distributed in proportion to their turnover ratio.

Now for a detailed understanding of ISD compliance, its registration, return filing, manner of distribution, treatment of eligible and ineligible ITC, ratio calculation, etc, visit our blog on understanding ISD under GST.

How ISD is essential for GST compliance efficiency

In common parlance, businesses have a principal office in one place and branches in various other locations for smooth business operation. While they operate from multiple locations, they may follow centralized billing for common input services received to avoid administrative complexity and ensure a streamlined process.

Now, even though there may be centralized billing in the name of the principal office or HO, as per section 16 of the CGST Act, ITC shall be availed by the unit that has actually received the services, i.e, the ITC has to be distributed to other branches also.

The real problem is what happened in the ITC distribution without the ISD mandate. Why did the government mandate the ISD mechanism even though it was operational voluntarily for the businesses?

Prior to 01-04-2025, i.e., before the mandatory implementation of ISD, businesses used varied methods for distributing ITC, like cross-charging, ad-hoc or non-frequent distribution, or at times non-distribution of ITC, leading to inconsistency or arbitrary distribution of credit across ITC.

Non-standardized ITC distribution increases the risk of claiming ineligible credits or failing to distribute credits to the correct branches with the correct amount. ITC was not distributed to states where services are consumed, violating GST’s destination-based principle.

Further, there was no inclusion of services received under RCM, where businesses struggled to allocate RCM credits on import services, services from unregistered providers, legal services, etc.

All these problems lead to GST compliance inefficiency and complexity, leading the government to mandate ISD from 1st April 2025.

How ISD solves these Problems

- Correct ITC Distribution- ISD ensures that the credit is not accumulated by the head office but passed on to all the units actually receiving services, optimizing ITC utilization and cash flow.

- Standard Distribution Process- With the ISD mandate, businesses have to mandatorily take ISD registration and distribute third-party input services ITC to all units in the ratio of turnover, maintaining the standard process and consistency.

- Regularized ITC distribution- ISD has to distribute ITC to all concerned units on a monthly basis and file a return in FORM GSTR-6 with details of Input service ITC received and distributed.

- Keep clear audit records- Since ISD involves system-driven distribution with proper documentation, businesses can maintain a clean audit trail. It’s easier to explain why a certain branch received credit and how the ratio was determined.

While ISD aims to streamline the distribution of ITC of common input services among various branches/locations or units, it is not easy, as the ISD provision itself can bring challenges during implementation. Here are some of the challenges a business may face in ISD implementation.

Challenges in ISD implementation faced by businesses

ISD module integration– Businesses that were following cross-charge or optional ISD must transition to implementing the ISD mandate and upgrade their ERP and GST compliance solution to support ISD, such as generating ISD invoices, tracking turnover-based ITC distribution, reconciliation of data with GSTR-6A, and integrating with the GST portal for GSTR-6 filings.

Vendor Coordination- Vendors must issue invoices to the ISD-registered office with the correct GSTIN, rather than branch GSTINs, for input services. Incorrect invoicing can lead to ITC mismatches, delays in credit distribution, or loss of eligible credits, increasing compliance risks.

Additional Compliance Burden- Businesses and tax heads are already juggling between GSTR-1 and GSTR-3B. Now with the ISD mandate, they must file GSTR-6 by the 13th of each month, detailing ITC distribution, and reconcile with GSTR-6A, which requires accurate and timely data compilation.

Determining eligible ITC– Businesses must accurately segregate eligible and ineligible ITC for distribution, as errors in distribution can lead to fines, penalties, and demands.

Turnover-based allocation complexity– ITC must be distributed based on the pro-rata turnover of branches in the previous financial year or quarter, as the case may be, as per Rule 39, CGST Rules, 2017. Any error in ratio calculation, as well as inaccurate or outdated turnover data, can lead to disproportionate ITC allocation.

Lack of Training for tax and finance teams– Lack of clarity, unawareness, or trained personnel on ISD mechanisms can lead to non-compliance risk.

Leveraging Technology for ISD Compliance

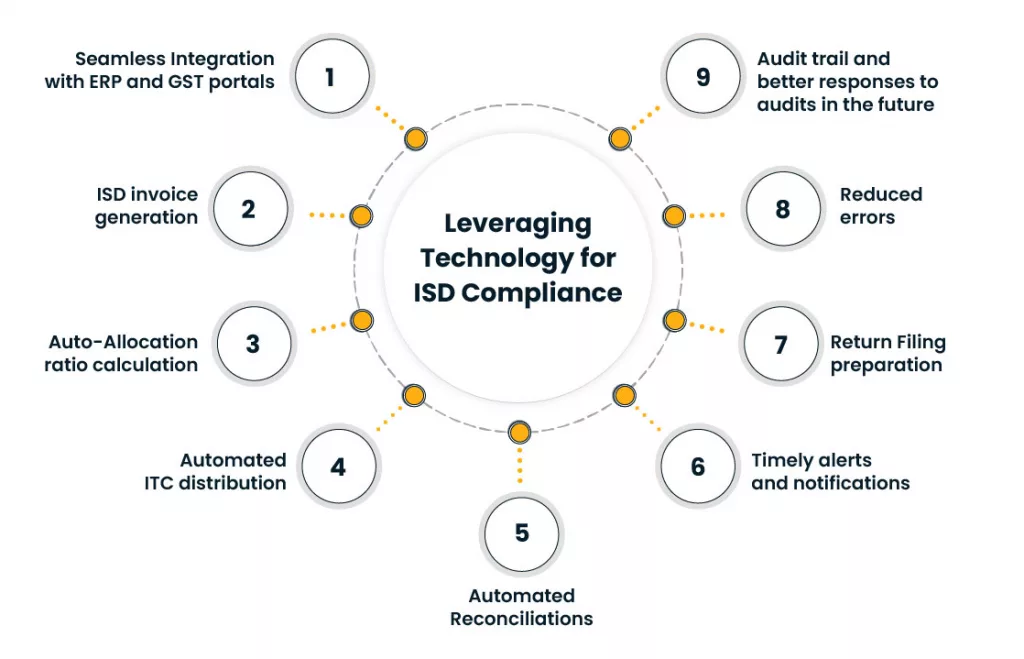

Tax Technology has become an integral part of tax compliance in today’s digital market. Integrating technology is no longer an option but a basic requirement to seamlessly comply with GST laws and regulations. Here is how leveraging technology can help in ISD compliance.

Seamless Integration with ERP and GST portals– The ISD solution can seamlessly integrate with ERP and GST portals to ensure automated flow of turnover data, common input service data, and automated filing to GSTR-6 on GST portals.

ISD invoice generation- The ISD module supports ISD invoice generation required for tax credit distribution, ensuring the invoice contains all required information as per law.

Auto-Allocation ratio calculation– ISD solution facilitates automated ratio calculation based on turnover in compliance with Rule 39 of CGST Rules 2017. It pulls turnover data from the previous financial year or quarter (for new branches) and computes the proportion of ITC each branch should receive.

Automated ITC distribution- The ISD module automatically calculates ITC to be distributed to attributable branches as selected by us and distributes ITC, covering both eligible and ineligible ITC separately, reducing manual errors and enhancing accuracy.

Automated Reconciliations- The ISD module facilitates the reconciliation of vendor invoices with GSTR-6A and ERP data, and it also reconciles the available ITC with the ITC actually distributed to ensure the correct GSTR-6 is filed.

Timely alerts and notifications- The ISD solution provides automated reminders for critical deadlines, such as GSTR-6 filing due by the 13th of each month or ISD invoice generation. It keeps compliance teams informed of upcoming tasks through dashboards, email alerts, or mobile notifications, ensuring no deadlines are missed.

Return Filing preparation- The ISD solution automates the preparation and submission of GSTR-6 returns, which detail Input tax credit distribution and are due by the 13th of each month. It compiles data from ISD invoices, reconciles with GSTR-6A, and submits returns directly to the GST portal, ensuring accuracy and timeliness.

Reduced errors– It employs validation algorithms and error-detection mechanisms to minimize mistakes in ITC calculations, vendor invoice errors, ISD invoicing, and GSTR-6 filings. It checks for inconsistencies before the data is finalized.

Audit trail and better responses to audits in the future – The ISD module maintains a digital record of all ISD transactions, including invoices, GSTR-6 filings, and reconciliation reports, creating a comprehensive audit trail. These records are stored securely and can be retrieved instantly during GST audits, ensuring transparency and traceability.

Sum Up

The ISD mechanism under GST, mandatory from April 1, 2025, is a pivotal tool for Indian enterprises to streamline Input tax credit distribution, ensuring compliance, transparency, and efficiency.

By addressing pre-mandate, ISD optimizes credit utilization, standardizes processes, and aligns with GST’s destination-based principle. Despite implementation challenges, leveraging technology enables businesses to overcome these hurdles, ensuring seamless compliance, reducing errors, and maintaining clear audit records, ultimately enhancing GST efficiency.