In an age characterized by accelerating digitization, governments worldwide are revamping the process of how taxes are calculated, reported, and enforced. One of the most significant changes in the works is the global use of e-Invoicing, in which electronic invoices are created, transmitted, validated, and stored in an electronic, structured format, often in real-time.

This shift is not merely about digitizing; it is about facilitating end-to-end tax and compliance automation. Starting in Asia and making its presence known in Europe, e-invoicing is increasingly the cornerstone for digital tax transformation, allowing businesses to adapt to the changing regulatory needs with accuracy, agility, and scale.

What is e-Invoicing and why is it increasingly popular worldwide?

E-invoicing, or electronic invoicing, is the process of automated invoicing and delivery in the digital format in an accepted, standardized form, usually certified by the government tax department prior to delivery to the buyer. In contrast to paper-based or PDF invoices, e-invoices are computer-based and sent through secure digital networks in compliance with local systems as well as real-time reporting requirements for taxes.

Governments are not only obliging e-invoicing in order to digitize compliance, but

- Reduce tax evasion

- Eradicate invoice fraud

- Enhance real-time visibility into business transactions

- Facilitate data-driven governance

In the European Union, Middle East, Africa, and Asia-Pacific markets, e-invoicing has transformed from an optional best practice into an obligatory digital compliance procedure—across B2B, B2G, and in selected B2C cases.

Frameworks in Detail: PEPPOL, Clearance, CTC, and Beyond

PEPPOL is the most standardized and interoperable model, currently implemented in the EU and multiple other countries globally.

Clearance vs. Reporting Model: What’s the Difference?

Clearance and real-time reporting are two distinct regulatory models for implementing e-invoicing and tax compliance across jurisdictions.

Clearance Model

In a clearance system, invoices must be pre-validated and approved by the tax authority before being sent to the buyer. This ensures tight tax control and upfront fraud prevention.

Key Characteristics:

- Government mandates a centralized platform (e.g., IRP in India, ZATCA in KSA)

- Invoice is considered valid only after clearance

- Often tied to QR codes, UUIDs, or unique reference numbers

- Ideal for high-fraud environments or jurisdictions with significant tax gaps

Examples:

🇮🇳 India (GSTN/IRP)

🇸🇦 Saudi Arabia (ZATCA Phase 2)

🇲🇾 Malaysia (Hybrid – IRBM clearance + PEPPOL)

Benefits:

- Strong anti-fraud mechanism

- Real-time validation = less chance of invoice mismatch or rejection

- Improves data quality for tax reporting

Limitations:

- Can slow down invoice processing if systems are down

- Integration with legacy ERPs can be complex

- High dependency on national infrastructure uptime

Real-Time Reporting Model

Here, invoices are issued normally between buyer and supplier but must be reported to the tax authority shortly after issuance—usually in real time or within 24 hours.

Key Characteristics:

- Doesn’t block invoice issuance

- Tax authority gains visibility post-facto

- Less intrusive than clearance but still ensures compliance

Examples:

- 🇭🇺 Hungary (NAV system)

- 🇪🇸 Spain (SII system)

- Singapore and Upcoming UAE

Benefits:

- More flexible for businesses and ERPs

- Doesn’t delay invoice issuance

- Supports high transaction volumes more easily

Limitations:

- Weaker fraud prevention vs. clearance

- Doesn’t stop non-compliant invoices from entering circulation

- May create a lag in enforcement or detection

PEPPOL, Non-PEPPOL, or Hybrid? How Countries Are Adopting

PEPPOL (Pan-European Public Procurement Online)

PEPPOL is an international framework built to standardize e-procurement and e-invoicing across countries. It’s now being adopted in Europe, APAC, and Middle East.

- Uses standard formats (like PINT XML)

- Relies on certified Access Points for sending/receiving documents

- Ensures interoperability across countries and sectors

- Supported by OpenPEPPOL governing body

Countries using PEPPOL:

Singapore | New Zealand | Belgium | Australia | Malaysia | UAE (in 5-corner model)

Benefits:

- Interoperability across borders

- Plug-and-play access via certified vendors

- 4-corner model keeps buyer/seller ERPs intact

- Supports scalability for MNCs and digital trade

Limitations:

- Doesn’t include real-time clearance by default

- Custom compliance rules of local authorities may still apply

- May require local extensions or configurations (e.g., Belgium’s BEPS)

Non-PEPPOL Systems

These are custom government-led infrastructures (e.g., GSTN in India or ZATCA in Saudi Arabia) that operate outside PEPPOL’s ecosystem.

- Often based on clearance models

- Built for domestic control and high fraud protection

- May be faster to implement for governments with localized objectives

Benefits:

- High fraud prevention and tax visibility

- Stronger regulatory enforcement

- Tailored to local market/business norms

Limitations:

- No global interoperability

- Complex ERP integrations

- Not suitable for cross-border trade

Hybrid Models

A growing number of countries are opting for hybrid models—combining the international reach of PEPPOL with the real-time compliance control of clearance or reporting systems.

Examples:

- 🇲🇾 Malaysia: PEPPOL + IRBM clearance

- 🇦🇪 UAE: 5-corner PEPPOL model + FTA verification

- 🇧🇪 Belgium: PEPPOL + BEPS with central BOSA exchange

These hybrid models allow countries to benefit from PEPPOL’s interoperability without compromising tax control.

The four corner model

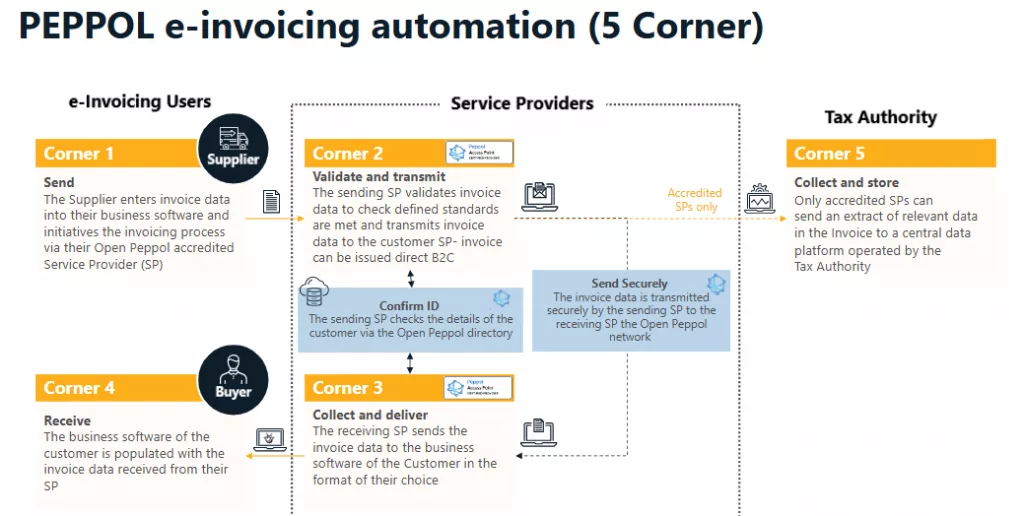

The Five corner model

4-Corner vs. 5-Corner PEPPOL Models: Key Differences

| Aspect | 4-Corner Model | 5-Corner Model |

| Flow | Supplier → Access Point A → Access Point B → Buyer | Same as 4-corner + Tax Authority sits in the middle |

| Validation | No tax validation by default | Invoice validated or reported to tax authority |

| Compliance | Voluntary or contractual | Mandated compliance by law |

| Control | More flexible for business networks | Stronger tax audit trail |

| Use Case | Belgium (From 2026) | UAE, Singapore |

The International Scene: Who Is requiring e-Invoicing and why

The implementation model for e-invoicing all over the world is diverse, each according to local infrastructure and tax needs.

We should consider the changing global scenario:

| Country | Mandate Start | Model | Notes |

| India | 2020 | Clearance | IRP-based GST e-invoicing |

| Saudi Arabia | 2021 | Clearance | Two-phase ZATCA model |

| Kenya | 2023 | Real-time (Non-PEPPOL) | KRA’s iTax system |

| Malaysia | 2024 | PEPPOL + Clearance | IRBM + IMDA PEPPOL model |

| Singapore | 2025 | PEPPOL | IMDA compliance with PINT format |

| UAE | 2026 | 5-Corner PEPPOL | FTA-DCTCE compliance |

| Belgium, France, Germany, Spain | 2024–2026 | PEPPOL + CTC | BOSA & national mandates |

In Europe, BOSA (Belgium) and the governments in France, Germany, and Spain are introducing e-invoicing mandates utilizing 4-Corner or 5-Corner PEPPOL models with centralized tax exchange portals and real-time verifications.

These models vary, but the thread that runs through them all is unmistakable—digitally enforced tax compliance is already the norm, not the future.

As e-invoicing becomes the backbone of digital tax compliance, the format in which invoices are structured plays a critical role in ensuring seamless interoperability, validation, and cross-border trade. While global frameworks like PEPPOL promote standardized formats, many countries continue to mandate their own localized specifications. Understanding the balance between international standards and domestic customizations is key for businesses operating across multiple jurisdictions. Two such examples are PINT and BEPS.

- PINT (Peppol International Invoice):

An XML-based standardized format by OpenPeppol, adopted in countries like Singapore, Australia, New Zealand, ensuring easy interoperability across borders.

- BEPS (Belgium E-Invoicing Standard):

National standard tailored to Belgian needs. While it aligns with PEPPOL to some extent, it includes additional requirements specific to Belgium’s BOSA authority.

Why this matters: Businesses operating in multiple regions need to accommodate both global standards like PINT and localized formats like BEPS, often within the same e-invoicing platform.

Why business should take notice: The ROI of Digital tax transformation

For businesses, e-invoicing is worth much more than the act of checking the compliance box. It is an engine for deeper finance and procurement transformation, enabling benefits such as:

- Reduced invoice rejections and instant validation

- Real-time reconciliation of tax credits

- Less manual intervention and shorter cycle times

- Increased cash flow visibility and control

- Audit trails integrated between ERP, finance, and tax systems

A real-world example? Cygnet recently enabled a leading Malaysian enterprise to generate 1,500+ monthly e-invoices in under 50 milliseconds, directly from their ERP, fully compliant with IRBM (LHDN) and PEPPOL guidelines. Read the success story

But there’s a catch: Complexity in Compliance

Despite the benefits, many enterprises feel overwhelmed. Why?

- There is confusion among the various frameworks

- Regular updates by the tax authorities such as GSTN, BOSA, ZATCA, IRBM

- Integration issues with legacy ERPs

- Limited internal awareness or willingness to embrace compliance tech

- There is an absence of able local partners in such jurisdictions with e-invoicing mandates

- Multinational companies (MNCs) must juggle multiple e-invoicing formats and standards across jurisdiction adding significant complexity to global operations.

Delay and inaction in preparation may result in penalties for non-compliance, restricted input credits, or disruptions in operations.

Cygnet.One: Enabling Scalable e-Invoicing Across Jurisdictions

With its experience in tax technology and digital compliance dating back ten years, Cygnet.One has helped business organizations confidently traverse multi-country e-invoicing requirements.

Cygnet accommodates PEPPOL and non-PEPPOL models, with localized compliance support in:

- India

- KSA

- Kenya

- Malaysia

- Singapore

- Belgium

- Zambia

The platform supports 125+ ERPs, global tax engines, real-time verifications, and data residency compliance for different regions—whether in the UAE, KSA, or the EU.

Cygnet is additionally an authorized PEPPOL Access Point and an accepted ASP for several nations’ tax authorities.

e-Invoicing + Indirect Tax: A Strong Synergy

When e-invoicing is combined with VAT/GST systems, businesses reap the following advantages:

- Real-time tracking of credits

- Preparation of automated tax returns

- Lesser numbers of mismatched and rejects

- End-to-end visibility for input-output taxes

This convergence guarantees CFOs, Tax Heads, and CIOs work off one source of financial truth, decreasing the risk of audit and maximizing working capital.

Conclusion: e-Invoicing Is no longer Optional

The e-invoicing age is now here—and rapidly extending its reach. From IRDA to GSTN, from BOSA to PEPPOL, global tax authorities are not just mandating, they’re transforming how companies approach compliance, inadvertently changing the global taxation landscape.

Companies that invest early in e-invoicing solutions that are global-ready will reap the benefits of quicker process flows, greater insights, and ironclad compliance. The automated, standardized, and digital future of tax. Are you prepared for leadership?