The global capability centers (GCC) and the Indian subsidiaries of multinational corporations (MNCs) are currently under GST scrutiny. The state and central level tax officials, along with DGGI, are investigating each case intensively, particularly regarding the classification of their export services, whether they are actually zero-rated supply or taxable under intermediary services.

Notices have already been sent to these companies operating in Bengaluru, Chennai, Maharashtra, Pune, Haryana, and NCR, providing IT, marketing, content development, R&D, designs, etc., services to overseas clients.

What are intermediary services?

An intermediary, as defined under Section 2(13) of IGST Act, is a broker, an agent, or any other person, by whatever name called, who arranges or facilitates the supply of goods or services or both, or securities, between two or more persons, but does not directly supply such goods or services or both or securities on his own account i.e. on principal to principal basis.

Now, as per section 13(8)(b) of the IGST Act, the place of supply in intermediary services is the location of the supplier. This means if the supplier is located in India, the place of supply will be India, and GST @18% will be charged on the service provided, irrespective of the fact that the service recipient is outside India.

Let’s understand this concept with a short example

Suppose there is a foreign company P which approaches a person Q in India to help P find potential buyers of Product mainly machineries, and Q helps find R. P and R enter into a sales contract with the help of Q. Here Q is not directly selling Machines to R but helped P and R to enter into contract for supply of Machinery

Here, the main supply is between P and R on a principal-to-principal basis for the sale of machinery. And the arrangement for this sale is facilitated by Q, which is considered an intermediary service.

Therefore, any payment received by Q from P to facilitate the sale of the machinery shall be liable to GST @18% even though P is located outside India.

Export or Intermediary: How service classification impacts GST liability and cash flow

In the export of services, GST is considered a zero-rated supply, meaning no GST liability on the supply of services to overseas recipients, subject to the conditions to be fulfilled as mentioned in the act. Therefore, the companies are eligible to get an ITC refund on the export of services if the supply is made without payment of tax.

While in intermediary services, the supply, even though made to the overseas recipient, is liable to GST if the location of the supplier of service is in India, meaning the supplier is liable to pay GST at an 18% rate on the said services.

Therefore, the supply of services made considering the zero-rated supply would become ineligible to be considered as zero-rated, if based on facts and contractual policy, it proves to be an intermediary service, and a tax liability of 18% will be charged on it, affecting the financial planning and cash flow of the company.

GST tax officials have already started rejecting the refunds of such companies, even though companies argue that they have provided services that clearly classify as export, impacting financial position and potentially costing crores, reducing India’s cost competitiveness, and a key benefit for MNCs and GCCs.

Further, as per taxo.online, India currently has over 1,700 GCCs, employing 1.9 million professionals, and generating $64.6 billion in revenue as of 2024. The sector is expected to expand to 2,400 GCCs, employing over 2.8 million and generating $105 billion in revenue by 2030. Industry experts warn that prolonged uncertainty over GST applicability could impact investor sentiment and India’s global positioning in the services sector.

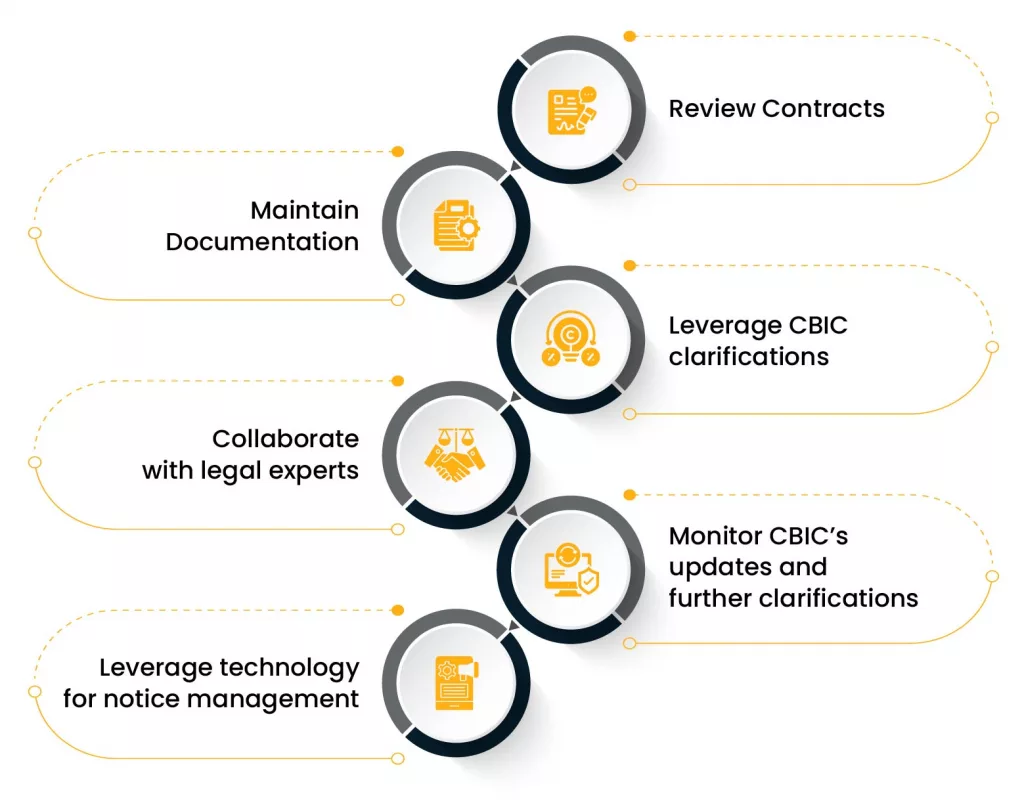

Actionable steps for MNCs and GCCs to address GST Notices

Here is the list of actions that may support MNCs and GCCs in ongoing debate and addressing the GST Notices.

Review Contracts

To avoid intermediary classification, MNCs and GCCs must be clearly able to ensure that the contract explicitly defines services on a principal-to-principal basis with no ambiguity or indirect interpretation of facilitation or agency.

Engage legal and tax teams to audit existing agreements, revise ambiguous clauses, and align with CBIC guidelines to secure zero-rated export status under Section 16 of the IGST Act, minimizing the risk of 18% GST liability as well as interest and penalty.

Maintain Documentation

Robust documentation is vital to prove services qualifies as export of service as per section 2(6) of IGST Act, requiring the place of supply to be outside India, payment in convertible foreign currency, the supplier has to be located in India, the recipient should be outside India, and they both should not merely be an distinct person.

Maintain detailed records such as invoices, client contract, service description, email correspondence, bank statement to show convertible foreign currency payment, service level agreements outlining deliveries, etc, to demonstrate the export of service to be on a principal-to-principal basis.

Implement technology and digital tools for centralized record keeping, streamline GST compliance, and manage GST notices, reducing the risk of refund denials and ensuring compliance with CBIC’s stringent requirements.

Leverage CBIC clarifications

CBIC circulars are binding on GST officials and provide authoritative guidance to argue against intermediary classification, particularly the services like IT, BPO, comprehensive marketing, etc., which are already clarified by the department.

Circular No. 159/15/2021-GST distinguishes intermediary services (e.g., facilitating goods sales) from principal-to-principal services (e.g., software development, customer care). Further this circular will support all IT/ITes and BPO/KPO services providers in litigations.

Circular No. 230/24/2024-GST clarifies that comprehensive marketing services qualify as export of service if it is provided on principal-to-principal basis. Circular No. 232/26/2024-GST confirms data hosting as a non-intermediary and can be classified as export of service, subject to fulfilment of other condition mentioned in Section 2(6) of IGST Act.

Use these circulars in responses to GST notices, citing specific illustrations and provisions to challenge notices. The legal team must provide references to these clarifications in audits and appeals, ensuring arguments align with CBIC’s intent to reduce litigation and support export-oriented sectors.

Collaborate with legal experts

GST notices on the current debate of whether there are intermediary services or not are often complex, confusing, and difficult to argue with, requiring special expertise to navigate the notices.

Engage tax consultants and legal professionals with deep knowledge of GST laws, CBIC circulars, and judicial precedents to get a positive outcome in the case. These experts can interpret companies’ contracts and laws accurately and craft a notice response with clear facts, grounds, arguments, judicial citation, legal backings, etc, to ensure a strong holding on the case and export status.

Monitor CBIC’s updates and further clarifications

The GST Council is likely to address the intermediary service debate in its upcoming GST Council meeting, potentially reclassifying intermediaries as exports to grant zero-rated status. This reform could resolve significant tax disputes and align GST with destination-based taxation principles. MNCs and GCCs should actively monitor updates via official channels like the CBIC website and industry forums to anticipate changes.

Stay informed with your tax expert, and as and when the intermediary services are reclassified, the companies must update compliance processes to claim a refund immediately without delays, as delays may prolong uncertainty.

Leverage technology for notice management

An automated AI-driven notice management solution like Cygnet’s can streamline notice responses, enhance accuracy, and improve compliance efficiency. These tools integrate with GST portals and ERP to fetch notices from the portal, generate a notice response template, facilitate research on similar judicial outcomes, maintain an audit trail, and provide centralized document management.

Leveraging Cygnet’s AI-enabled litigation management solution facilitates centralized case data, automates notice tracking, and streamlines response preparation, reducing human errors and ensuring timely replies to avoid penalties.

The system facilitates advanced reconciliation by integrating with ERP and extracting critical data effortlessly to support robust notice responses. Cygnet also has a team of legal experts to support and ensure that the notices are responded to accurately and on time.

By leveraging technology, MNCs and GCCs can minimize delays, cut administrative costs, and strengthen defences against tax demands, ensuring seamless notice resolution.

Conclusion

In conclusion, interpreting the intermediary services or export is a puzzle, and debatable unless backed by strong supporting documents proving the export of services. While the government may reclassify intermediary services to provide relief to MNCs and GCCs, there is still a long wait.

Till then, the businesses must prepare themselves for rejected refunds, respond to notices, and ensure they are in a strong position to defend and argue for the services to qualify as exports.

Leveraging technology for notice management, hiring experts, staying updated, reviewing and revising contracts to align with law, etc, are a few actionable steps MNCs and GCCs must start taking before it is too late.