As we approach the last week of December 2025, it’s clear that electronic invoicing has moved far beyond a compliance requirement. It has become the backbone of digital tax administration, financial accuracy, and real-time business operations across the world. In the past decade, more than 70 countries have implemented or announced e-invoicing mandates, driven by ongoing digital tax reforms, widening VAT/GST gaps, and a global shift toward automated, data-driven regulation.

As mandates expand worldwide, many organizations are moving toward unified e-invoicing software that supports real-time reporting and multi-country compliance.

2025 was the year when AI in invoice processing evolved from “experimental” to “essential.” Governments strengthened Continuous Transaction Controls (CTC), industries adopted PEPPOL e-invoicing standards, and enterprises integrated e-invoicing more deeply into ERP and financial ecosystems than ever before. As organizations prepare for 2026 and beyond, understanding these changes is crucial.

This blog explores the top 5 e-invoicing trends of 2025, the lessons they offer, and how they are shaping the compliance and finance landscape moving into 2026.

Trend 1: Global Mandates Accelerated Faster Than Ever (Setting Up 2026 as a Compliance-Heavy Year)

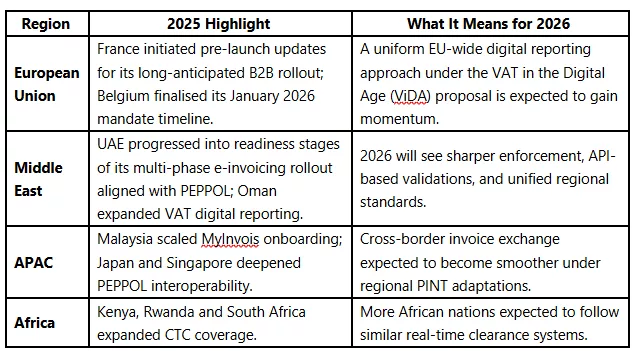

2025 was the most active year in regulatory expansion since Italy’s original CTC rollout in 2019. Governments across EU, APAC, LATAM, and the Middle East accelerated their digital tax journeys. Several jurisdictions moved from voluntary or B2G models to mandatory B2B electronic invoicing.

Major regulatory highlights in 2025

As per government data (European Commission, IRBM Malaysia, UAE FTA, Japan Digital Agency), digital tax reporting is increasingly tied to closing VAT gaps, which remain a multi-billion-dollar challenge globally.

Why this trend matters for the next 12 months

2026 will be a year where:

- More countries adopt real-time invoice validation.

- Digital reporting replaces batch submissions.

- Tax administrations demand cleaner, audit-ready datasets.

- Businesses must strengthen ERP readiness and integrations.

To keep up with these accelerating requirements, enterprises increasingly rely on automated e-invoicing solutions that ensure clearance, validation, and regulatory alignment across regions.

The era of casual compliance is officially over. Continuous compliance is the new normal.

Trend 2: Interoperability Became the Global Language of E-Invoicing

A clear shift in 2025 was the transition from “country-specific systems” to “interoperable e-invoicing ecosystems.”

The PEPPOL e-invoicing standard became central to this transformation.

Key Drivers Behind Interoperability Adoption

1. Widespread adoption of PINT (PEPPOL International Invoice)

PINT became the preferred baseline for cross-border e-invoicing, enabling local customizations such as:

- PINT-AE (Middle East)

- JP-PINT (Japan)

- PINT-APAC (regional alignment)

This allowed multinational companies to standardize formats across regions while still meeting local compliance schemas.

2. Governments prefer “network-based” exchange

PEPPOL’s 5-corner model created secure, structured invoice flows between Access Points, government platforms, and trading partners.

Data became more traceable, and authenticity could be verified without multiple file reconstructions.

3. Businesses demand unified formats

Enterprises operating in multiple jurisdictions are tired of managing dozens of XML variants. Interoperability reduces:

- Data discrepancies

- Onboarding friction

- Implementation cycles

- Vendor management gaps

According to a 2025 McKinsey Global Trade Report, interoperability may reduce cross-border invoice processing costs by 25–40% in the next three years.

What this means for 2026

Interoperability will no longer be optional.

Governments will increasingly adopt PEPPOL or hybrid PEPPOL-CTC models, pushing enterprises to put standardization and validation frameworks at the center of their finance operations.

Trend 3: AI Transformed Invoice Processing—But 2026 Will Take It Even Further

AI in invoice processing took its most significant leap in 2025. However, what we saw was only the beginning.

How AI advanced in 2025

1. Context-aware validation

AI created validation layers that could:

- Detect tax rate anomalies,

- Identify inconsistent line items,

- Predict likely rejection from tax systems based on historic patterns.

2. Serious improvements in fraud detection

Governments and enterprises used AI to flag:

- Duplicate invoices disguised with small variations,

- Supplier impersonation attempts,

- Tax computation irregularities,

- Risky transactional patterns.

3. Near-zero manual intervention in AP teams

AI-enabled invoice classification and field extraction now reach 97–99% accuracy, according to 2025 Gartner AP research.

4. Real-time compliance scoring

Invoice risk levels could be assigned instantly, helping companies prepare for future audits.

How AI will evolve in 2026

2026 will bring:

- AI-led real-time tax calculation validation at point of invoice creation

- Predictive dispute management

- Self-healing data pipelines that auto-correct metadata

- Autonomous workflows where invoices are fully processed without human touch

- AI-generated compliance summaries ready for tax audits

AI’s next frontier is collaborative intelligence—systems that learn from historical invoice behaviors and improve validation schemas dynamically.

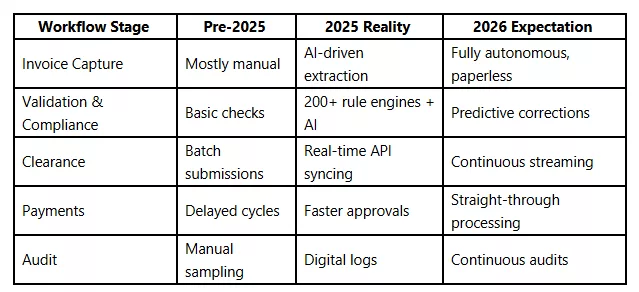

Trend 4: E-Invoicing Became Fully Embedded in Finance Ecosystems

2025 saw enterprises converge their financial systems—e-invoicing was no longer a standalone compliance layer but became part of full digital finance ecosystems.

Integration highlights from this year

- Deep ERP integration: Companies demanded connectors for SAP, Oracle, Microsoft Dynamics, and custom ERPs.

- Unified AP automation: Vendor onboarding, document validation, invoice approval, and e-invoicing clearance became a unified flow.

- Real-time audit trails: Digital trails reduced statutory audit hours significantly.

- Data unification: Finance leaders gained real-time visibility into working capital and vendor performance.

Illustrative View: How Finance Workflows Shifted in 2025

The future of finance is not fragmented.

It is connected, automated, and compliance-first by design.

Trend 5: Businesses Shifted to ROI, Sustainability, and Strategic Value

2025 highlighted a crucial shift: organizations no longer implement electronic invoicing only for regulatory mandates—they expect measurable business impact.

Key ROI outcomes noted in 2025

- Faster invoice processing cycles (50–70% reduction)

- Lower cost per invoice, often down to one-third of manual processes

- Reduced dispute and rejection cases

- Increased early payment discounts due to faster approvals

- Lower paper usage supporting ESG goals

- More accurate financial reporting

The environmental aspect is becoming central. Governments in the EU, APAC, and GCC have emphasized digital processes as part of their national sustainability agendas.

How ROI will strengthen in 2026

- Finance teams will benchmark invoice cycle times and cost savings more rigorously.

- ESG reporting will include metrics on paperless operations and digital audit trails.

- Digital tax compliance will align more closely with enterprise risk management frameworks.

Organizations will ask one crucial question in 2026:

“How much value is our e-invoicing platform unlocking beyond compliance?”

Conclusion

As 2025 closes, one thing is clear: e-invoicing is no longer a linear operational workflow—it is a strategic pillar of digital finance and tax governance.

With governments accelerating mandates, interoperability frameworks maturing, and AI reshaping how invoices are created, validated, and reported, enterprises must prepare for real-time, insight-driven, connected compliance in 2026.

Organizations that modernize early will gain the most—through efficiency, accuracy, sustainability, and competitive advantage.

FAQs

1. What will be the dominant e-invoicing trend in 2026?

AI-driven, real-time invoice validation and interoperability via PEPPOL/PINT frameworks.

2. Are more countries expected to mandate e-invoicing in 2026?

Yes. EU countries, GCC jurisdictions, and several APAC governments are moving toward CTC systems.

3. Will AI replace manual invoice processing?

Not entirely, but 2026 will see 80–90% automation in AP workflows.

4. How does e-invoicing improve sustainability?

Paperless operations reduce carbon footprint and contribute to ESG reporting metrics.

5. How should businesses prepare for upcoming mandates?

Modern ERPs, interoperability compliance, AI-ready validation engines, and real-time integration with government systems.