Commercial transformation is taking place at a fast pace with the help of digital innovation in the BFSI industry.

A set of tools, methods and processes that improve operational activities and enhance sales constitutes commercial transformation using digital innovation for BFSI. It not only streamlines critical functions and repetitive tasks but also automates and digitizes them. It also enables enhanced security features and improves the risk management process in the industry.

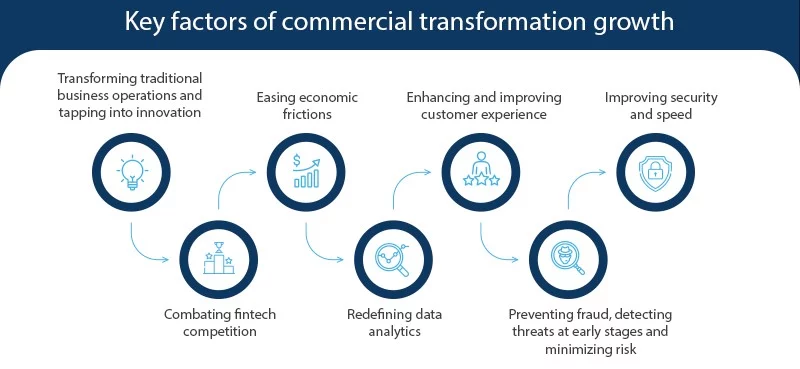

While digital innovation in 2019 was estimated at $52.44 billion in the BFSI market worldwide, by 2027, it is projected to reach $164.08 billion, according to the statistics provided by Allied Market Research. The industry knows the current economic and competitive challenges will make the status quo unsustainable. The key factors that drive this growth are:

Let’s check how these factors help in commercially transforming the BFSI industry using digital innovation.

Transforming traditional business operations and tapping into innovation

A variety of offerings – such as “neo-banks”, vertical offerings with seamless payments and embedded lending, white-labelled or cobranded point-of-sale, buy now pay later offerings, digital-first merchant-acquiring business, bank accounts linked to all financial services through one-stop-shop, crypto-payments networks or exchanges, cross-bank utilities, white-label banking-as-a-service API platform – have come up globally in BFSI industry. This makes tapping digital innovation irrevocable and necessary for a business to thrive and survive in the industry.

Unlike earlier, repetitive tasks can be easily automated with digitalization using Artificial Intelligence (AI) and Machine Learning (ML). This also ramps up lending and payment services by creating value through the customer journey by providing advanced analytics and personalization.

Combating fintech competition

According to a McKinsey survey, BFSI that focus on new business building are more than twice as likely to see average revenue growth of more than five times, over seven years, compared to their peers who do not focus on new business building. Other strategies to counter market competition include large-scale M&A, bolt-on deals and digital transformation of the core business. Of all these, digital innovation for commercial transformation is the most effective way.

The rapid adoption of mobile devices, IoT solutions, and cloud technology among the banking and fintech industries has created competition in the industry. More customers are now relying more on fintech offerings for general banking, wealth management, payments, and lending as the shift to digital-first channels has made them trust and rely more on these. In this situation, digital technology can unlock opportunities and bring transformative changes to meet customer demands and behaviour shifts.

Easing economic frictions

A surge in customized IT solutions for specific banking needs like open banking and APIs has become the new currency of the networked economy. With the introduction of open banking, traditional banks are partnering with fintech solutions for their services. The industry invests heavily in developing APIs to offer a more seamless and efficient customer experience. Some large banks consider APIs as the product and deeply invest in the product management of APIs.

Redefining data analytics

With the growth in acceptance of advanced technology, such as AI and ML, and a multitude of analytical techniques that can parse large quantities of data in real-time (without overlooking the conventional statistical methods), are being utilized to usher into the age of data analytics.

The common challenges in data analytics discussed in leading fintech firms – data silos, privacy fears, and dearth of talent – can be easily overcome using digital innovations like AI that take multidimensional insights into action rather than applying empirical rules of the traditional approach.

AI/ML can help identify a high volume of behavioural data and patterns of customers that can be used for data analytics through its algorithms to provide insights for business development.

Enhancing and improving customer experience

Like any other business, a BFSI business also looks forward to creating functional, smooth customer experiences. This is where cloud infrastructure and services come in as a cost-efficient solution that reduces silos across customer support and finance by enabling improved collaboration between internal teams, partners and customers. This results in increased productivity, speedier development cycles, and enhanced speed to market.

Preventing fraud, detecting threats at early stages and minimizing risk

The industry needs to adapt and innovate as the fraud risk environment changes. Traditional approaches to fraud mitigation cannot suffice, and technology plays a significant role in mitigating instances of fraud in the very initial stages.

Similarly, while lending out loans, credit risk assessment is essential as it is challenging to evaluate the end use of the loan while evaluating SME.

Improving security and speed

To provide secure and fast transaction channels to customers, a large number of banking and fintech industries are adopting blockchain technology. Also, blockchain increases transparency and accountability in transactions and supports the greater adoption of cross-border payments.

Digital payments have also become swifter with the use of biometrics in digital channels.

Conclusion

Digital innovation is and will continue to play a significant role in redefining the BFSI industry of the future. Cygnet Digital can help you transform this digital innovation journey to achieve commercial transformation in the BFSI sector as we bring an in-depth understanding of business and industry with over two decades of fintech experience, robust technology partnerships, required digital competencies and best-in-class perspective.

Let Cygnet Digital be your technology partner in growth and innovation. Reach out to us today!