Malaysia’s transition to a nationwide e-Invoicing framework marks one of the most significant tax digitalisation initiatives in Southeast Asia. Led by the Inland Revenue Board of Malaysia (IRBM/LHDN), the mandate aims to introduce real-time, data-driven transparency across B2B, B2C and B2G transactions.

As businesses prepare for the staggered rollout between 2024 and 2027, a recurring concern among CFOs, tax heads, and compliance leaders is how the e-Invoicing process works specifically for transactions with buyers — acceptance, rejection, workflow timelines, and dispute protocols.

This isn’t just about digitizing invoices. The Inland Revenue Board of Malaysia (IRBM, also known as Lembaga Hasil Dalam Negeri Malaysia or LHDN) has established a Continuous Transaction Control (CTC) model that validates every e-invoice in real-time before it reaches your buyer. Simultaneously, the Malaysian Digital Economy Corporation (MDEC) oversees the Peppol framework for seamless business-to-business invoice exchange.

Why This Matters for Your Business:

- Legal Requirement: Non-compliance can result in penalties up to RM20,000 or 6 months imprisonment under Section 120(1)(d) of the Income Tax Act 1967

- Operational Impact: Different rules apply when buyers do or don’t require e-invoices

- Timeline Pressure: Critical changes take effect January 1, 2026, including the RM10,000 individual invoice threshold

- Strategic Advantage: Early adopters benefit from tax deductions up to RM50,000 annually (Budget 2025 incentive)

Understanding the Two E-Invoicing Pillars in Malaysia

1. IRBM/LHDN: Tax Reporting & Compliance (Mandatory)

- Purpose: Real-time tax validation and revenue tracking

- Platform: MyInvois Portal or API integration

- Coverage: All B2B, B2C, and B2G transactions

- Format: UBL 2.1 (XML or JSON)

- Validation: Each invoice receives a Unique Identification Number (UIN) and QR code

2. MDEC: Business Digitalization via Peppol (Voluntary but Recommended)

- Purpose: Seamless invoice exchange between businesses

- Network: Peppol 4-corner model with accredited Service Providers

- Standard: Peppol International Invoice (PINT) MY v1.2.0

- Advantage: System-to-system automation, cross-border compatibility

Key Insight: You must comply with IRBM validation requirements. Using Peppol is optional but streamlines the process significantly, especially for businesses with multiple trading partners.

1. Malaysia’s e-Invoicing Mandate: Updated Rollout Timeline

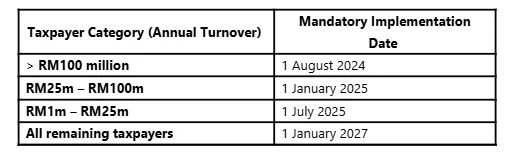

As per the revised rollout schedule announced by IRBM in October 2023 and reconfirmed via subsequent 2024 FAQ releases:

Source: LHDN e-Invoice Guideline (2024) (https://www.hasil.gov.my/en/e-invoice/)

This applies to:

- Domestic B2B

- Domestic B2C

- B2G invoice flows

- Cross-border transactions

Source: LHDN e-Invoice FAQ (October 2023 & 2024 updates)

2. Understanding the Malaysian e-Invoicing Framework

Malaysia has adopted a continuous transaction control (CTC) framework, requiring suppliers to submit invoices to LHDN for validation before they become legally valid.

Two submission modes exist:

- MyInvois Portal (manual uploading) – suitable for micro/small businesses

- API-based submission – for medium/large enterprises integrating ERPs or POS systems

After validation, LHDN assigns:

- A Unique Identifier Number (UIN)

- A digital signature

- Delivery of validated invoice to the buyer

This ensures all parties operate on verified, tamper-proof fiscal documents.

The Buyer–Supplier Lifecycle in Malaysia’s e-Invoicing System

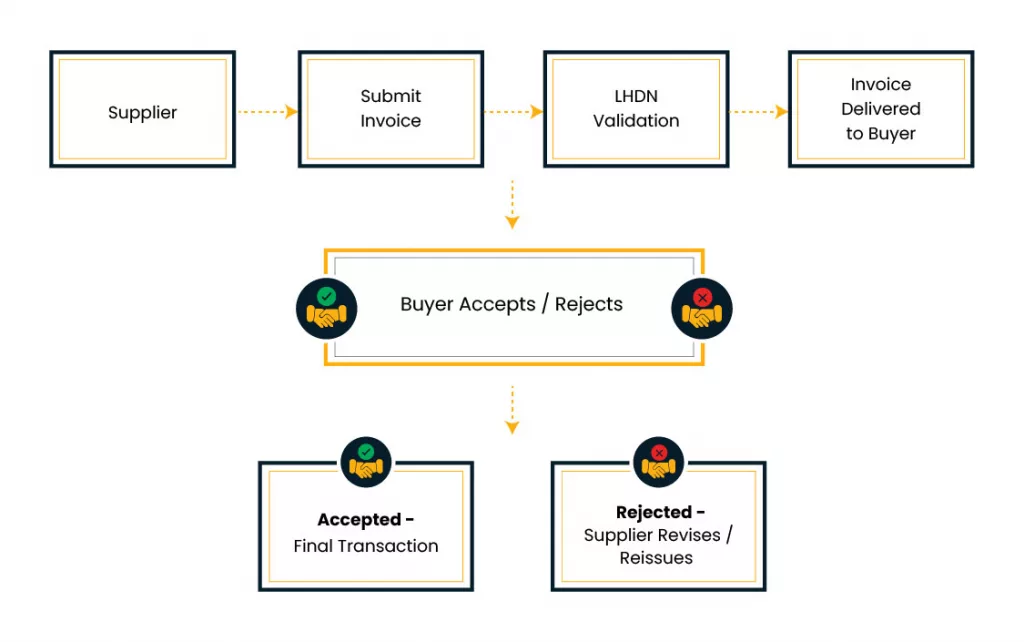

Malaysia’s buyer workflow is more interactive than in other countries. Once LHDN validates the supplier’s e-Invoice, the buyer has an active role in accepting or rejecting it.

High-Level Workflow Diagram \

Step-by-Step Buyer Response Process

After validation, the buyer receives the e-Invoice through:

- MyInvois portal

- API integration

- Email (PDF + JSON)

They must then choose one of the following:

1. Accept the e-Invoice

Acceptance means:

- Invoice is final

- Amount becomes payable

- Buyer records it in their accounting system

Acceptance can be manual or automatic after 72 hours.

2. Request Rejection

The buyer may request rejection within 72 hours of receiving the invoice.

Valid reasons as defined by LHDN (Source: LHDN e-Invoice Guideline 2024):

- Incorrect price

- Incorrect quantity

- Incorrect buyer details

- Wrong tax treatment

- Duplicate invoice

- Errors in description or contract references

3. No Response (Silent Acceptance)

If the buyer does not respond within 72 hours, LHDN auto-accepts the invoice.

The Full 72-Hour Buyer Rejection Cycle

Buyer-side validation is time-sensitive. Here’s the breakdown:

| Stage | Party | Time Limit | Outcome |

| Request rejection | Buyer | Within 72 hours | Sent to supplier |

| Accept/reject buyer’s request | Supplier | Within next 72 hours | Determines whether invoice is cancelled |

| No action | Supplier | After 72 hours | Auto-acceptance |

Total cycle time: 144 hours (6 days)

What Happens After Buyer Rejection?

If Supplier Agrees

Supplier cancels invoice → Issues a new corrected invoice → Submits to LHDN.

If Supplier Does Not Agree

Supplier can ignore the request → Invoice becomes automatically accepted.

This protects suppliers from misuse of rejection requests.

Buyer vs Supplier Responsibilities: Side-by-Side Comparison

| Activity | Supplier | Buyer |

| Create e-Invoice | ✔ | ✖ |

| Submit for LHDN validation | ✔ | ✖ |

| Validate transaction accuracy | ✖ | ✔ |

| Initiate rejection | ✖ | ✔ |

| Provide rejection reason | ✖ | ✔ |

| Cancel & reissue | ✔ | ✖ |

| Record validated invoice | ✔ | ✔ |

Special Considerations for B2C, Self-Billed & Cross-Border Flows

1. B2C Transactions

- No buyer rejection cycle

- Supplier only needs to display QR code to consumer

Source: LHDN e-Invoice Guideline (B2C Section)

2. Self-Billed Transactions

Buyer issues invoice on behalf of supplier.

Common cases include:

- Agents

- Reverse charge

- Agriculture or services where buyer controls valuation

In this scenario, buyer validation is not required post-issuance.

3. Cross-Border Transactions

Required for:

- Imports

- Exports

- Services from foreign suppliers

Malaysia follows similar documentation but aligned with LHDN’s cross-border schema.

Example Scenarios to Understand Buyer Interaction

Scenario 1: Quantity mismatch

Buyer sees wrong item quantity → Requests rejection → Supplier agrees → Reissues.

Scenario 2: Buyer cannot respond

Buyer busy → No action → Invoice auto-accepted.

Scenario 3: Price dispute

Buyer rejects → Supplier reviews PO → Supplier rejects buyer’s rejection → Invoice auto-accepted.

Scenario 4: Tax treatment issue

Buyer corrects SST/GST classification → Supplier reissues corrected invoice.

How e-Invoicing Impacts Accounting, Audit & Reporting

Malaysia’s e-Invoicing introduces several process-level changes:

1. Real-time reporting

Invoices must be submitted immediately upon issuance.

2. Mandatory data points

LHDN defines strict schema fields such as:

- Buyer TIN

- Supplier TIN

- Tax treatment code

- Item classification

3. Digital audit trails

All invoice exchanges remain permanently available on LHDN servers.

4. Uniform document types

Malaysia standardises:

- e-Invoice

- Credit Note

- Debit Note

- Self-Billed Invoice

5. Integration with ERP

Businesses must ensure:

- API connectivity

- Real-time validation

- Automated buyer acceptance tracking

Source: MyInvois Technical Specification v1.2 (2024)

Malaysia and PEPPOL: Where Does It Stand?

As of early 2025:

- Malaysia is not a PEPPOL jurisdiction,

BUT

- It references international interoperability standards.

- The MyInvois API uses structured data similar to global CTC models.

Source: MDEC Digitalisation Initiative Reports (2024)

Summary: What CFOs Should Prioritise in 2025

The buyer–supplier workflow is the core compliance element of Malaysia’s e-Invoicing model.

CFOs should ensure:

✔ Internal teams understand the 72-hour rejection rules

✔ ERP systems capture buyer responses and match POs

✔ Contract teams define acceptable rejection reasons

✔ AP departments monitor silent acceptance risks

✔ Accounting teams map LHDN’s schema requirements

Mastering this process reduces:

- reconciliation disputes

- tax errors

- audit risks

- working capital blockage

Malaysia’s e-Invoicing is not merely a tax reform — it is a process transformation.

FAQ’s

1. Is buyer validation compulsory for all e-Invoices?

Yes, for all B2B transactions, buyers must accept or reject within 72 hours.

2. What happens if the buyer does nothing?

The invoice is auto-accepted.

3. Can a supplier refuse a rejection request?

Yes. If the supplier disagrees, invoice is auto-accepted after 72 hours.

4. Which portal is used for e-Invoicing?

The MyInvois Portal, provided by LHDN.

5. Are B2C receipts included?

B2C invoices are included but do not require buyer validation.

6. Are foreign suppliers required to issue Malaysian e-Invoices?

Cross-border supplies are included as per IRBM guidelines.

7. How are credit notes issued?

They must reference the validated original invoice and go through LHDN validation.

8. Is PEPPOL mandatory in Malaysia?

No. Malaysia runs its own MyInvois infrastructure.

9. Can businesses use ERPs for automated submission?

Yes, via API integration.

10. How long are validated invoices stored?

LHDN maintains long-term audit trails.

11. Are self-billed invoices allowed?

Yes, for specific industries and contract arrangements.

12. Does e-Invoicing replace SST/GST obligations?

No, it complements tax reporting, not replaces it.