Filing the GST annual return (Form GSTR-9) and the reconciliation statement (Form GSTR-9C) is a critical part of annual GST compliance for businesses in India. GSTR-9 summarizes a taxpayer’s yearly outward supplies and taxes thereon, inward supplies, input tax credits (ITC), it’s availment, taxes paid during the year, and it’s alignment with the periodic GST returns (GSTR-1 and GSTR-3B) filed during the year. Whereas GSTR-9C aims to report the reconciliation between turnover as per GST returns or GSTR-9 and audited financial statement.

Also, only adhering to this annual compliance is not sufficient, rather accurate filing of annual returns holds equal importance. As discrepancies in the return can lead to unnecessary department communications and. For FY 2024-25 in particular, the government has introduced several changes to the GSTR-9 and GSTR-9C formats to improve transparency in reporting and reconciliation, making it a point to file the return more attentively and accurately.

Businesses can simplify year-end reporting and reduce reconciliation errors by using an automated GST compliance solution that keeps filings accurate and audit-ready throughout the year.

What is GSTR-9 & GSTR-9C?

GSTR-9 (Annual Return)

As mentioned above GSTR-9 is the annual return that summarizes all GST transactions for a financial year, it is important to know who must file the annual return. Every regular taxpayer with aggregate turnover above ₹2 crore except an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person is mandatorily required to file GSTR-9. However, it’s optional for those having turnover below ₹2 crore.

This form essentially consolidates the information from your monthly/quarterly GSTR-1 (a statement of outward supplies) and GSTR-3B (summary returns) filed during the year and helps identify any discrepancies or omissions over the year. GSTR-9 also enables to report the transactions pertaining to current financial year but taxes paid in the subsequent year. A due date for filing GSTR-9 for a financial year is 31st December of the subsequent year. Thus, for FY 2024-25, the due date to file the return is 31st Dec 2025.

GSTR-9C (Reconciliation Statement)

GSTR-9C is a reconciliation statement cum audit form that compares the data in GSTR-9 with the figures in the audited annual financial statements of the business. In simpler terms, it’s a turnover and ITC reconciliation – ensuring that the turnover, taxes, and ITC reported to the GST authorities match with the Books of Accounts (BOA), with the valid explanations for any differences. Every registered taxpayer having aggregate annual turnover above ₹5 crore in the financial year are required to file GSTR-9C. Notably, GSTR-9C no longer needs to be certified by a Chartered Accountant; and it is a self-certified return by the taxpayer. However, a requirement to attach the audited financial statements while filing GSTR-9C still exists. The due date for GSTR-9C is the same as GSTR-9 i.e. 31st December of the subsequent year. And it can be filed only after filing of GSTR-9.

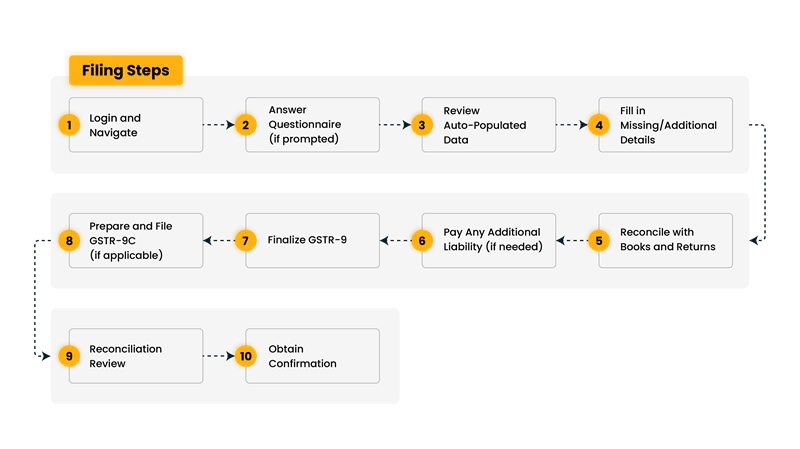

GSTR-9 and GSTR-9C Filing Steps

Filing GSTR-9 and 9C is a step-by-step process on the GST portal. Before you begin, ensure that all your monthly/quarterly GSTR-1 and GSTR-3B returns for the year are filed. The annual return utility will only be enabled once all the returns are filed for the financial year.

Here’s how to proceed with filing:

1. Login and Navigate

Log in to the GST portal with your credentials. Go to Services → Returns → Annual Return. Select the Financial Year (2024-25) for which you are filing, then choose Form GSTR-9 and select the option “Prepare Online”.

2. Answer Questionnaire (if prompted)

The system may ask a few initial questions (e.g. whether you had any transactions under certain heads) to enable or disable certain sections of the form. Respond appropriately to streamline your filing. For example, if you had no amendments or no ITC reversals, the form may skip those sections. (Ensure you carefully read any instructions during this step.)

3. Review Auto-Populated Data

The form will be pre-filled with details based on the GSTR-1 and GSTR-3B filings for the year wherever possible. Review the auto-populated tables and check if the B2B, B2C supplies, taxes paid, ITC availment populated as per the records or workings. If you notice any discrepancies in the auto-populated values , you may correct the same.

4. Fill in Missing/Additional Details

Certain tables of GSTR-9 that are not auto-populated require manual entry, especially those that weren’t captured in GSTR-1/GSTR-3B. With the changes that are brought in FY 2024-25 onwards, the option to enter ITC reversed under new categories (Rule 37A, Rule 38) and ITC pertaining to previous year availed in current financial year (Table 6A1) through separate tables have also been provided. Fill all applicable fields. If a section doesn’t apply to you, you can leave it blank or enter “0”. (Note: Some tables might be optional if not relevant – for instance, Table 15 on “Demands and Refunds” can be left blank if you had no GST demand or refund in the year.)

5. Reconcile with Books and Returns

After filling in, preview the draft GSTR-9 summary on the portal. Cross-verify each figure with the trial balance and GST return working papers. Her key reconciliations to be checked include:

- Total turnover (taxable + exempt) as per books vs. what’s declared in GSTR-9 (Tables 4,5). These should match or differences should be explainable (e.g., year-end unbilled revenue or sale of fixed assets, which would be handled in GSTR-9C).

- Tax paid: The sum of CGST, SGST, IGST, Cess payable (Table 9) should match the total tax liability actually paid via GSTR-3B during the year. Now that Table 9 clearly shows any difference in tax payable vs tax paid, ensure this difference column is zero or justified. If the difference is not zero, taxpayer likely need to pay additional tax through DRC-03.

- ITC availed: The total ITC claimed in Table 6 Vs ITC available as per GSTR-2B in Table 8 if shows the difference, appropriate reporting needs to be made in the relevant tables so that the ITC seems to be appropriately reconciled with transparency. It is important to remember, any ineligible credit that is reversed should also be reported in Table 7.

- Previous year adjustments: If you had reported any invoice, debit note or credit notes dated FY 24-25 during the period Apr 25-Oct 25, ensure those are captured in Table 10 & 11 correctly. Also, if any ITC pertaining to current year reversed in the subsequent year or ITC pertaining to current year availed in subsequent year shall be reported through Table 12 & 13 respectively. (For example, an ITC of March 2025 that could not be claimed during the year and is claimed in Aug 2025, then such transaction becomes the part of Table 13).

6. Pay Any Additional Liability (if needed)

If the verification of the financial statement finds that some taxes were short-paid during the year or not paid at all, such additional liability should be paid before filing of GSTR-9 through DRC-03. And the details of the payment can be reported in GSTR-9C. Notably, the form GSTR-9 for FY24-25 explicitly shows if there’s any shortfall in taxes paid and the taxpayer wishes to pay off the additional liability, GSTR-9 now allows utilization of ITC for paying these dues which was only allowed through cash earlier.

7. Finalize GSTR-9

Once all numbers are verified and liability is offset, validate the return which shall highlight the errors or mandatory fields missed. As the form is validated error free, confirm the declaration and use your DSC (for companies/LLPs) or EVC (for others) to submit the return. On successful filing, an Acknowledgement Reference Number (ARN) will be generated – download the filed GSTR-9 PDF and save the ARN receipt for the records.

8. Prepare and File GSTR-9C (if applicable)

After filing GSTR-9, taxpayers with turnover above ₹5 crore need to file GSTR-9C. This can be prepared online or via offline utility. Below are the points to be remembered when preparing GSTR-9C form:

- Prepare Financial Statements and Documents: Ensure your financial statements for FY 2024-25 (Profit & Loss statement and Balance Sheet) are audited and signed. You will need the audited annual accounts or at least the final trial balance and a detailed ledger of taxes and ITC, since GSTR-9C involves reconciling these with the GST returns. If your accounts are audited by a CA, have the audit report handy as well.

- Part A – Reconciliation Statement: This section has various tables reconciliation between turnover reported in audited financial statement and turnover declared in GSTR-9 has been reported. Table 5B to Table 5N has listed various reasons of reconciliation between revenue as per BOA & revenue as per GSTR-9. It further also provides reconciliation of rate wise liability and amount payable thereon. Please note it is important to report the difference between the two in the respective table unless not listed since the goal is to explain the gap between the two records.

- Part B: Certification: Here the taxpayer certifies that the reconciliation is true and correct. Attach the required documents – specifically, a copy of the audited financial statements (P&L and Balance Sheet) and any supporting schedules or audit reports. Although the form need not be certified by CA, if the taxpayer has undergone a GST audit by an expert, the GST audit report issued can also be attached. Sign the GSTR-9C digitally and submit the same at the portal.

9. Double-Check GSTR-9C Before Submission

The portal may auto-fill some values in GSTR-9C from the GSTR-9 filed like total turnover as per GSTR-9, total taxes paid as per GSTR-9, etc. After preparing GSTR-9C, perform a thorough check of the amounts and the reconciliations reported. For example, the reasons for reconciliation between BOA and turnover as per GSTR-9 are correctly mentioned in the respective tables and there remains no unreconciled turnover. Value of Exempt, Nil rated or Zero rated supplies reported the Reconciliation of Taxable Turnover i.e. Table 7 are in line with the amount reported in GSTR-9. After the thorough examination of the form GSTR-9C, submit GSTR-9C with DSC/EVC. Like GSTR-9, an ARN will be generated, and it is advised to save for records

10. Obtain Confirmation

After both GSTR-9 and GSTR-9C are filed, your annual compliance is complete. You can download copies of the filed forms anytime from the portal from the “View Filed Returns” section. However, it’s a good practice to preserve all the GST Annual Return Working Paper – including all reconciliations, calculations of tax differences, along with it’s reasons from the future point of view.

Further, we shall also look at some challenges to watch out for during the process, and tips to overcome such challanges.

Challenges in Filing Annual GST Returns

Filing GSTR-9 and 9C accurately can be challenging due to the sheer volume of data and the need for meticulous reconciliation. Here are some common challenges and pitfalls taxpayers face:

1. Data Reconciliation Issues

One of the major challenges is making sure the figures in GSTR-1, GSTR-3B, GSTR-9, and your financial books are all aligned. Many taxpayers discover discrepancies at year-end where turnover as per GSTR-1 and turnover as per GSTR-3B are not matching due to missed amendments or reporting errors. Similarly, there could be an excess availment of credit than available in GSTR-2B or a Purchase Register. Such mismatches can lead to time-consuming investigations to identify missing invoices or incorrect availment of ITC. Failing to reconcile properly may result in under-reporting or over-reporting in GSTR-9.

2. Mismatch between Books and Returns

It’s common to find that the annual sales or ITC per your BOA differ from what was reported in monthly GST returns, especially when corrections or audit adjustments are made at the year end. Year-end entries like accruals, write-offs, or stock adjustments might not have been reported during the monthly GST returns. GSTR-9C is meant to capture such entries, but identifying and quantifying each difference is a challenge. Each variance needs a reason. Ensuring no legitimate transaction is omitted or no fictitious entry is included requires careful combing through accounts.

3. ITC Mismatch and New IMS Impacts

With FY 2024-25, the Invoice Management System (IMS) integration means Table 8A pulls credits based on invoice dates, possibly including some ITC which appeared in GSTR-2B of the next year. This could flag inconsistencies if your books don’t record the ITC in the same period as per the invoice date. Taxpayers who are not aware of this change might be puzzled seeing Table 8 differences or even risk over-claiming ITC if they blindly rely on GSTR-2B of only 12 months. A correct accounting for invoices reported by the suppliers in subsequent year becomes crucial. Conversely, any invoices dated from the previous FY that popped up in the current year’s GSTR-2B will not show up in Table 8A now onwards, so if one isn’t careful about the reporting of such invoices, they might end up wrongly considering the same as missed ITC and double-claim the credit. Navigating the new ITC auto-pop rules is a notable challenge this year.

4. Missing or Incorrect ITC Reversal Details

Taxpayers sometimes make mistakes reporting ITC reversals or ineligible credits separately rather they will report the Net of reversals. For example, if a taxpayer had to reverse ITC due to a supplier’s GSTIN cancellation or for not complying with the payment within 180-days rule, such reversal should be disclosed in Table 7 separately. A common mistake is not reporting such reversals or reporting through the wrong table. Now that GSTR-9 has enabled the option to report each type of reversal through a separate table, incorrect reporting may not present the true picture which may lead to double reversal of ITC in future. Similarly, any transitional credit or excess availment reversed later also needs to be taken care of.

5. Errors in Reporting Amendments and Adjustments

During the year, taxpayers may have issued credit notes, debit notes, or amended invoices. In the annual return, same need to be disclosed in the respective table with correct values. A challenge arises if one mistakenly nets off amendments in the wrong place. For instance, amended invoices for the year should not be directly added to Table 4H; rather it should be reported in Tables 4I-4L (for amendments of taxable outward supplies) or in Table 5J/5K for amendments of non-GST supplies. The form also mandates showing original and amended values separately in separate tables for clarity. It is also easy to overlook credit notes related to exempt supplies or GST rate changes adjustments if records aren’t clear.

6. Time Crunch & System Glitches

As the GST Audit deadline approaches, many businesses scramble to compile data. This rush increases the risk of mistakes and omissions. Last-minute filers often encounter GST portal slowdowns or errors due to heavy traffic. Any system glitches like auto-population errors or portal calculation differences can be stressful to resolve under tight timelines. For FY 2024-25, the portal enabled GSTR-9 filing on 13th October 2025, which is later than usual. This has already compressed the available filing window. Procrastinating the filing of return till the due date increases the possibility of facing technical issues with less time to troubleshoot.

7. Understanding New Requirements

The changes in forms and reporting mechanism have already brought in the need to learn and analyze reporting disclosures and its impact. Not only taxpayers but even professionals may find the new tables and instructions confusing at first. For example, flagging the transaction to split between Table 6A(1), 6A(2) and Table 6H can be little challenging. One must determine which ITC entries belong to prior year vs. current year vs. reclaimed (based on an invoice date). Misinterpreting the changes may lead to incorrect reporting or additional reversal of ITC. Likewise, in GSTR-9C, ensuring that no differences are inadvertently clubbed together (given the removal of the 5O relaxation) requires diligence. In short, the novelty of the FY 2024-25 form updates poses a challenge, as taxpayers prepare to report information that wasn’t required in previous years.

8. How to overcome these challenges

The key to overcome these challenges is thorough reconciliation and planning way ahead of the due date. Awareness of these common issues, proactive control over them, and preparing work papers that facilitate quick and clear disclosures is the crucial first step.

Having discussed the challenges above, let us discuss the best practices that can help ensure an accurate and hassle-free filing of GSTR-9 and 9C.

Best Practices for Accurate GSTR-9 and 9C Filing

To file the annual return and reconciliation statement accurately, consider the following tips and best practices adopted by GST experts and compliant businesses:

1. Start Early and Reconcile Regularly

Don’t wait to start off the GST audit for reconciling the data. Ideally, perform monthly or quarterly reconciliations of GSTR-1, GSTR-3B, and filed returns with BOA. Regular reconciliation of turnover and ITC will make year-end filing much smoother and faster. This shall allow taxpayers to report pending invoices or debit notes, pertaining credit notes within the extended period of subsequent year. Early reconciliation also gives time to chase vendors for any missing invoices or corrections for ITC mismatches Also, an ITC can be claimed for the financial year within an extended period if reconciled in time.

2. Leverage Technology (Use Tools/Software)

Manual compilation of a year’s data is a cumbersome task and prone to error. Consider using GST accounting software or the official offline utility. The GST portal provides an Excel/JSON offline tool for GSTR-9 – use it to prepare and validate data offline and catch errors before upload. There are also third-party GST reconciliation tools that can automatically compare your GSTR-2B with purchase registers using advanced logics and AI giving optimum match or flagging mismatches. Automation significantly reduces clerical errors and saves time, especially for businesses with high volumes of transactions.

3. Maintain Thorough Documentation

Good record-keeping is crucial. Maintain a file of all supporting documents needed for the annual return. This includes sales registers, purchase registers, expense ledgers, GST edgers, working papers of monthly GST returns filed, tax payment challans, refund orders, etc. during the year. Also keep the detailed workings of ITC reversals (e.g., calculations for Rule 42 common credit reversal) and any other reconciliations performed. Having everything in hand allows you to quickly fill in the forms and provide backup if any value is questioned. In case of an audit or inquiry, being able to produce invoice-wise details or reconciliation statements will substantiate the figures in GSTR-9/C.

4. Double-Check Auto-Populated Figures

While the portal auto-fills many fields, do not assume they are correct. Cross-verify auto-populated figures like outward supplies, input tax credit, and late fees with your own calculations. Sometimes credit notes or amendments filed late might not reflect as expected. With the improved auto-population and change in the disclosure mechanism for FY 24-25, data accuracy is better, but it’s still a taxpayer’s responsibility to ensure nothing remains unchecked. If an auto-filled figure seems off say, ITC as per GSTR-2B in Table 8A, use the new invoice-wise details available at the GST portal to investigate and reconcile differences rather than blindly accepting or overriding it.

5. Utilize New Portal Features

Take advantage of new features the GST system offers for annual returns. For example, the ability to download the HSN/SAC summary from GSTR-1 can save effort in preparing Table 17. Simply verify and use that data to fill in the HSN details (ensuring you meet the 4-digit/6-digit requirement based on turnover). Similarly, use Table 8A invoice-wise ITC report to identify which invoices are contributing to the auto-populated ITC, and ensure your books have accounted for all of them. Such tools reduce manual data entry and errors, making your filing more accurate.

6. Focus on GSTR-9C Reconciliation

For taxpayers required to file GSTR-9C, invest time in the reconciliation process. Map out each difference between the audited financials and GST returns. Differences arising during the reconciliation should have a clear explanation. For instance, difference due to capital goods sale accounted in books but GST paid under margin scheme. Ensure if the reason for difference in the reconciliation is listed between Table 5B to Table 5N same should be disclosed in the respective table only. If Any table is not applicable, then it is a good practice to put “0” so that no table remains unattended. Remember that the relaxation of combining all differences into Table 5O is no longer in existence. Also, make sure the ITC as per books and ITC claimed as per returns (GSTR-9) is reconciled in a way that excess ITC claimed than available in BOA or ITC available in BOA and yet to be claimed or ineligible ITC not yet expensed out in BOA can be figured out. A properly filled GSTR-9C with no unexplained variances is your best defense against future scrutiny.

7. Validate ITC Claims

Carefully validate the ITC claimed during the year. This means matching your purchase register with GSTR-2B statements. Ensure every line of ITC availed is in line with the ITC rules. Any credit not reflected in GSTR-2B by the cutoff period i.e. Oct 2025 for FY 24-25 is ineligible and should be reversed – confirm such reversals are done and reported in GSTR-9. Also, verify if ITC have been claimed on ineligible items like personal expenses or blocked credits under GST law. Reconciling ITC at frequent intervals will enable timely rectification of wrong ITC availed and reduce the chance of double or excess availment of ITC. Also, it is important to note that ineligible ITC or a common credit reversal is given impact in BOA so that such ITC do not appear in Input GL during the reconciliation which can mistakenly be availed if overlooked.

8. Check for Unreported Liability

Reconciliation between BOA and monthly returns filed may have the difference due to the reason of unreported liability due to various reasons. Common examples include interstate sales inadvertently treated as intrastate transactions, rate difference, revenue billed in books but missed to be reported in GSTR-1, or non-identification of transaction falling under reverse charge mechanism. The annual return is a chance to identify such unpaid liabilities and voluntarily discharge the same to avoid future penalties.

9. Be Mindful of Optional Tables

Several tables in GSTR-9 are optional or have relaxations if not applicable. For instance, Table 18 HSN of inward supplies is optional for all businesses – most taxpayers skip it unless they want to provide that information. Table 15 and 16 refunds/demands, and information on supplies from composition or deemed supplies are also optional. If there is no data to be reported under optional tables same can be left blank. However, not making disclosures under optional tables, doesn’t leave any important information from reporting. For example, if a GST refund is sanctioned in the year, it is better to make the disclosure in Table 15. Filling the data in optional tables may provide clearer picture of BOA and may save the taxpayer from the unnecessary notices.

10. Verify Amendments and Transition Entries

Make a checklist of any prior-year amendments or late debit/credit notes you dealt with. Verify that all FY 2023-24 items reported in Apr-Sep 2024 are captured in GSTR-9 FY 2023-24 (not again in 2024-25), and conversely any FY 2024-25 items reported late (Apr-Oct 2025) are captured in Tables 10-13 of FY 2024-25’s return. This prevents duplication or omission across fiscal years. Essentially, tie out your Part V of last year’s GSTR-9 with Part V of this year’s to ensure continuity. It’s good practice to keep a small worksheet or a working paper tracking such cross-year movements of sales/ITC.

11. Plan for the Deadline (Avoid Late Fees)

The due date of December 31 is strict. Missing it incurs a late fee of ₹200 per day (₹100 CGST + ₹100 SGST), capped at 0.25% of your turnover. This can become a significant amount for delays of several days or weeks. Additionally, for FY 2024-25, late filing of GSTR-9C also attracts a late fee. To avoid these penalties, plan to file the returns well before the deadline. A smart plan is to finalize numbers by early December, complete GSTR-9 filing by mid-December, and GSTR-9C (if needed) by the third week of December. This buffer helps you steer clear of last-day portal issues and gives time for any unexpected complications. Remember, there is no provision to revise GSTR-9 or 9C after filing, so you want to file it correctly in one go and not under panic on Dec 31.

12. Consult a Tax Professional if Needed

If you are unsure about any aspects such as the treatment of a complex transaction in the annual return or the recent format changes—do not hesitate to seek guidance from a Chartered Accountant or GST consultant. This is especially important for GSTR-9C, which requires interpreting differences between accounting and GST treatment. An expert can help ensure accuracy, compliance, and consistency. Professionals can also offer insights on optimized reporting for example, how to present a specific adjustment in the reconciliation and review your draft returns. This is particularly valuable for large businesses or multi-GSTIN organizations where consolidation can be complex. In essence, a quick professional review can serve as a safety net against costly errors.

By following these best practices – regular reconciliation, leveraging tools, meticulous verification, and staying informed about the changes, you can vastly improve the accuracy of your GSTR-9 and GSTR-9C filings. Filing of annual GST returns after thorough examination of BOA not only makes you a compliant taxpayer but also gives you insights about the business and areas to improve in terms of maintaining BOA or documentation etc.

What’s New for FY 2024-25

The annual return forms for FY 2024-25 include several important updates and new disclosure requirements that filers should be aware of:

1. Enhanced ITC Reporting

ITC related to previous years must be separately disclosed. A new sub-table 6A1 has been introduced to report any ITC from FY 2023-24 that was claimed in FY 2024-25 (up to the October 2025 return). Meanwhile, ITC reclaimed due to compliance by the supplier (Rule 37A) or 180-day payment rule (Rule 37) is now reported under Table 6H instead of mixing with current year ITC. This segregation provides clarity on carry-forward credits versus current year credits.

2. Separate ITC Reversal Details

In GSTR-9, Table 7 (ITC reversals) now requires granular reporting of each type of ITC reversal. Two new fields are added specifically for ITC reversed under Rule 37A reversal on account of non-payment of tax by the supplier and Rule 38 where 50% credit reversal is required for banks/NBFCs. Unlike earlier years, all the reversals cannot be summed up into “Other reversals” (Table 7H), Each category (7A to 7E) must be reported separately from FY 2024-25 onward. This change means taxpayers need to keep detailed track of ITC reversed during the year along with it’s reasons.

3. Changes in Auto-Populated ITC (Table 8)

The reconciliation of ITC as per returns vs. as per suppliers (GSTR-2B) in Table 8 has been revamped. Table 8A will now auto-populate only ITC for invoices pertaining to FY 2024-25, even if those invoices were reported by suppliers late (for example, in GSTR-2B of April–Oct 2025) . This date-based inclusion of ITC via the new Invoice Management System helps capture “late-reported” credits for the year. Invoice-level details for the entries counted in Table 8A can be downloaded from the GST portal, aiding in reconciliation. Another tweak: Table 8B (ITC as per GSTR-3B) will now consider only current-year credits (excluding any reclaimed credits) to avoid mismatches. There’s also a new row 8H(1) to report any ITC on imports for FY 2024-25 that was availed in the next year. – ensuring import credits carried over to next year are transparently disclosed.

4. Tax Payment and Liabilities (Table 9)

Table 9 will now include upfront reporting of the difference between tax payable, and tax actually paid. Taxpayers must provide clear reasons for any positive variance and furnish payment proof where the variance is negative. Cross-Year Adjustments (Tables 10-13): Disclosure of transactions or ITC pertaining to one year but reported in the next year has been made mandatory where applicable. Table 12 (ITC reversed in FY 2025-26 relating to FY 2024-25) and Table 13 (ITC availed in FY 2025-26 for FY 2024-25, up to the cut-off) are now compulsory to fill if such adjustments exist. In previous years these were optional, but for 2024-25 you must report these to give a complete picture of ITC adjustments across the years. Similarly, any sales of FY 2024-25 reported through GSTR-1 of Apr-Sep 2025 returns go into Table 10/11 of GSTR-9. (Note: If any FY 2023-24 transactions were already disclosed in last year’s annual return, they should not be repeated in the FY 2024-25 GSTR-9, to avoid double reporting.)

5. HSN Summary and E-commerce details

Table 17 (HSN/SAC summary of outward supplies) remains required for large taxpayers (turnover > ₹5 Cr, 6-digit HSN) – but the GST portal now provides a downloadable consolidated HSN report from your GSTR-1, making it easier to compile this data. Meanwhile, new reporting has been introduced for sales made via e-commerce operators under Section 9(5). Such supplies (where the e-commerce operator pays the tax) must be separately shown, ensuring they are not mixed with regular sales. This clarifies turnover from platforms like food delivery apps or cab aggregators, where GST is discharged by the platform.

6. Changes in GSTR-9C

The FY 2024-25 GSTR-9C form also has notable updates. In the turnover reconciliation (GSTR-9C Part II), each adjustment from Tables 5B through 5N must be reported separately – you can no longer simply club all differences into “Others (Table 5O)” as a single line. The prior relaxation allowing combined disclosure in 5O was available only up to FY 2021-22. Practically, this means if your turnover as per BOA vs. turnover as per GST differs due to, say, unbilled revenue, contra entries, foreign exchange fluctuations, etc., each category should be quantified in its respective line. Only uncategorized differences like opening unbilled revenue can be in 5O as a last resort. Additionally, new Tables 12B & 12C are no longer optional from FY 2023-24 onwards. This shows a spotlight on ITC reconciliation, requiring the taxpayer (or auditor) to explicitly confirm whether there are any ITC differences between books and returns. In summary, the GSTR-9C for FY 2024-25 demands more detailed reconciliation and transparency, ensuring any variance above permissible limits is clearly reported and justified.

These changes for FY 2024-25 aim to improve accuracy, transparency and year-to-year consistency in GST reporting. Taxpayers should familiarize themselves with the new fields and requirements early on, as they may need to adjust internal accounting or data gathering processes accordingly.

Conclusion

Filing GSTR-9 and GSTR-9C accurately is more than just a statutory obligation – it’s a reflection of how well a business has maintained its GST records and compliance throughout the year. A well-prepared annual return and reconciliation statement help ensure that a taxpayer doesn’t pay more tax than required, nor leave any dues unpaid, thereby avoiding future disputes. The FY 2024-25 changes in the annual return format underscore the government’s push for greater precision and transparency in reporting. Taxpayers are expected to segregate data year-wise, reconcile with system-generated records like GSTR-2B, and provide detailed justifications for any anomalies. Embracing these requirements by maintaining clear records and making thorough reconciliations will turn what might seem like a daunting compliance task into a manageable yearly routine.

In summary, accurate GSTR-9 and 9C filing can be achieved by starting early reconciling all figures, leveraging the latest tools and features, and staying updated on GST rule changes. It ensures your annual GST compliance is airtight which not only avoids penalties and late fees but also strengthens your credibility with tax authorities. As the December 31, 2025, deadline approaches for FY 2024-25, equip yourself with the right data and mindset. By following the tips outlined above and paying special attention to the new reporting changes, you can file your GST annual return and reconciliation confidently and correctly. This proactive compliance will keep your business GST-compliant, audit-ready, and free from unnecessary financial stress in the long run. Happy filing!