Are primitive payment methodologies and broken processes preventing your business growth?

Purchasing on credit is nothing new, but tech-driven solutions, such as digital payments using blockchain technology and mobile payments, play a pivotal, transformative role within the payments ecosystem. Technology brings clear competitive advantages that will help businesses survive by bringing down the market risk with timely payments and making them thrive.

Processes involved in BNPL

Buy now, pay later (BNPL) is a short-term financing option that enables customers to make purchases and pay in the future, mostly interest-free (if the amount is paid timely). Though BNPL helps you deliver a winsome experience, it is at a very budding stage. It involves tiresome processes, including manual reconciliations, multiple communication channels, laborious paperwork, multiple systems of engagement and discretionary underwriting of risks.

Need for integrating technology with BNPL

As businesses have apprehended the importance of technology interventions, many standalone tools are being accepted to provide credit by compulsion or compel distributors to avail credit.

With technology at the forefront, businesses that want to bring more efficiency, improvisation, and innovation in their transactions, are now testing data-driven automated credit access and payment methods. The uncertainty that inflationary pressures present make access to capital even more important. Thus, adopting technology becomes a solution rather than an option for large enterprises and their supply chain ecosystem in such contexts.

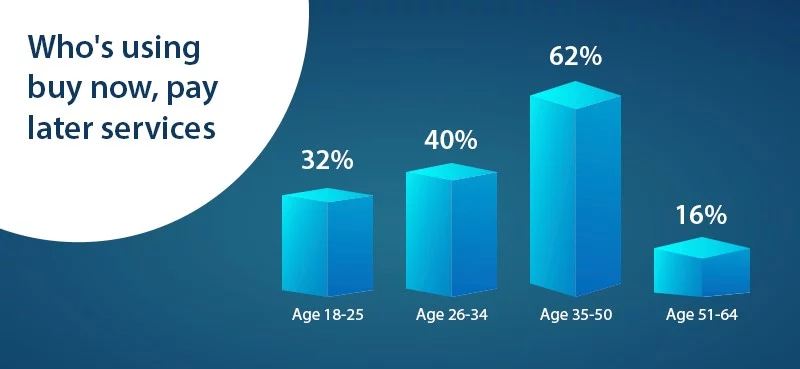

Digital payments with BNPL play a significant role in scaling the business in both B2B and B2C transactions. No wonder we witnessed an exponential growth in the number of people using BNPL from a mere 6% in 2019 to a sixfold increase to 36% in 2021!

The Global Payments Report 2021 by Worldplay from FIS also indicates that BNPL is becoming the payment option of choice in online shopping and is expected to double its share by reckoning for 13.6% of the eCommerce spend in Europe. Allied Market Research also predicts expansion in the BNPL market size at a CAGR of 45.7% from 2021 to 2030, from evaluating $90.69 billion in 2020 to a projected reach of $3.98 trillion by 2030.

Benefits of BNPL digital payments for business

BNPL digital payments offer a range of advantages to customers and businesses alike. Let’s know more about these benefits for your business.

• Significant increase in sales

Customers and business partners love the liberty to split their transactions into smaller instalments, thereby creating a win-win situation. By splitting up purchases over a longer span of time, your online business can make big deals much more affordable, thereby widening your audience, including the younger audience.

With tech-driven platforms bringing in the necessary infrastructure, the cash flow burdens of businesses and their entire supply chain ecosystem can be decreased considerably. They also eliminate time-consuming processes and make credit-related decision-making processes fast, easy and transparent.

• Competitive advantage by improving trust and relationships with customers and partners

Integrating digital payments to BNPL using blockchain technology can make the transactions more secure and aligned with insurable risks. This enhances trust and relationships with customers and business partners.

Also, as a business recovers payment timely with digital payments enabling BNPL, businesses are more likely to extend more credit, resulting in an increase in the number of customers and enhancement of mutual trust and association with customers and business partners. This equates to more sales, happier customers, satisfied business partners, and overall business growth.

• Convenience, affordability, and flexibility

With the much-desired suppleness and option for long-term payment in increments, your customers can afford to make purchases using BNPL payment preferences, leading to increased sales in business. Customers can apply online for approval almost instantly and choose a payment frequency that fits their budget.

Similarly, with options for a score-driven underwriting approach, and affordable access to technology and credit, your business partners feel empowered as they experience more control over their transactions.

• Integration and engagement throughout the purchase journey

Digitalized processes using integrated payment and engagement models make a business prefer digital payments for BNPL to keep the customers hooked and drive revenue. Advanced technological capabilities like integrations into shopping carts and sophisticated consumer-service tools also help to build a brand image, contribute to sales and engagement, and help businesses get much better access and visibility into younger customers and their credit behaviour.

Conclusion

Digital payments driving BNPL will be coming up as massive opportunities as business models and partnerships in the industry. So, rather than just waiting and watching — it’s time to plunge in and ride the crest of the BNPL wave.

Cygnet Digital has developed the capabilities vital to building fintech platforms that capture functionality and design in one place to create ideal solutions for its clients and end-users in the financial services sector.