Innovation is the driving force behind business success. Industries are witnessing significant transformations with the integration of artificial intelligence (AI) and automation.

By 2024, banking will be one of the top industries spending on artificial intelligence.

About 80% of finance leaders have implemented or are planning to implement RPA.

One such powerful combination is “Hyperautomation,” a groundbreaking approach that has revolutionized the banking and insurance sectors. It is one of the top technology trends of 2023. Let’s dive into the world of AI-powered hyperautomation and explore its transformative impact.

Introduction

Hyperautomation is the next frontier of technological advancements, representing a seamless integration of AI and automation technologies. It entails the use of AI-driven tools, machine learning algorithms, and robotic process automation (RPA) to streamline and optimize complex business processes. This holistic approach extends beyond repetitive tasks and aims to create an ecosystem where intelligent systems autonomously learn, adapt, and optimize processes in real-time.

The rise of hyperautomation

The global market for hyperautomation is expected to reach $1.04 trillion by 2025.

To appreciate the significance of hyperautomation, it’s essential to understand its evolution. Traditional automation has a long history, dating back to the Industrial Revolution when machines were first employed to replace manual labour. However, traditional automation had its limitations, as it lacked the ability to handle intricate tasks that demanded human-like decision-making.

The advent of AI brought about a paradigm shift in automation. AI algorithms enabled machines to analyze vast amounts of data, identify patterns, and make intelligent decisions. This paved the way for hyperautomation, where AI and automation joined forces to create a dynamic and self-learning automation environment.

An increasing number of banking, financial services, and insurance (BFSI) sectors are adopting hyperautomation to streamline their operations and enhance efficiency, profitability, speed, accuracy, and resilience. By leveraging technologies such as low-code BPM, RPA, and ML, businesses can expedite customer onboarding, generate reports, manage data, and automate transactions more swiftly and accurately than done manually.

The use of hyperautomation can transform the workforce within a company by replacing monotonous and repetitive tasks with more creative work. This frees employees up to concentrate on value-based tasks that foster empathy and decision-making. With hyperautomation and low-code, banking operations can attain greater flexibility, allowing seamless collaboration across different departments.

How hyperautomation impacts banking

The banking sector has been at the forefront of adopting hyperautomation services to redefine its operations. Hyperautomation has reshaped the financial landscape from enhancing customer experience to optimizing backend processes.

In customer-centric services, hyperautomation facilitates personalized interactions and prompt query resolution through AI-driven chatbots and virtual assistants. It expedites account management processes, allowing banks to focus on building stronger customer relationships.

Risk assessment and fraud detection are critical aspects of banking. Hyperautomation empowers banks to analyse vast datasets in real-time, enabling more accurate risk evaluation and fraud detection.

Hyperautomation in the insurance industry

The insurance sector has also embraced hyperautomation to improve its services. Claims processing, often a labour-intensive process, has become more efficient with the automation of repetitive tasks. AI-powered underwriting models assist insurers in assessing risks and offering personalized insurance policies to customers.

Customer engagement is vital for insurers, and hyperautomation helps in building stronger connections through automated communication channels like chatbots. Additionally, data analytics in hyperautomation provides insurers with valuable insights for better decision-making.

The role of AI in hyperautomation

AI plays a pivotal role in the success of hyperautomation. Machine learning and predictive analytics enable systems to learn from data, identify patterns, and make data-driven predictions. Natural language processing allows banks and insurance companies to interpret unstructured data like customer feedback and reviews.

RPA automates routine tasks, streamlining workflows and freeing up human resources to focus on high-value tasks that require creativity and critical thinking.

Challenges and concerns

Evolution from automation to hyperautomation into the financial industry brings up numerous challenges and concerns. It is crucial to prioritize data security and privacy due to the sensitive information that banks, and insurance companies handle. Additionally, ensuring the ethical use of AI in finance, such as avoiding bias in decision-making, is of utmost importance. Workforce adaptation to hyperautomation is another challenge, as employees may need to acquire new skills and roles may evolve in response to automation.

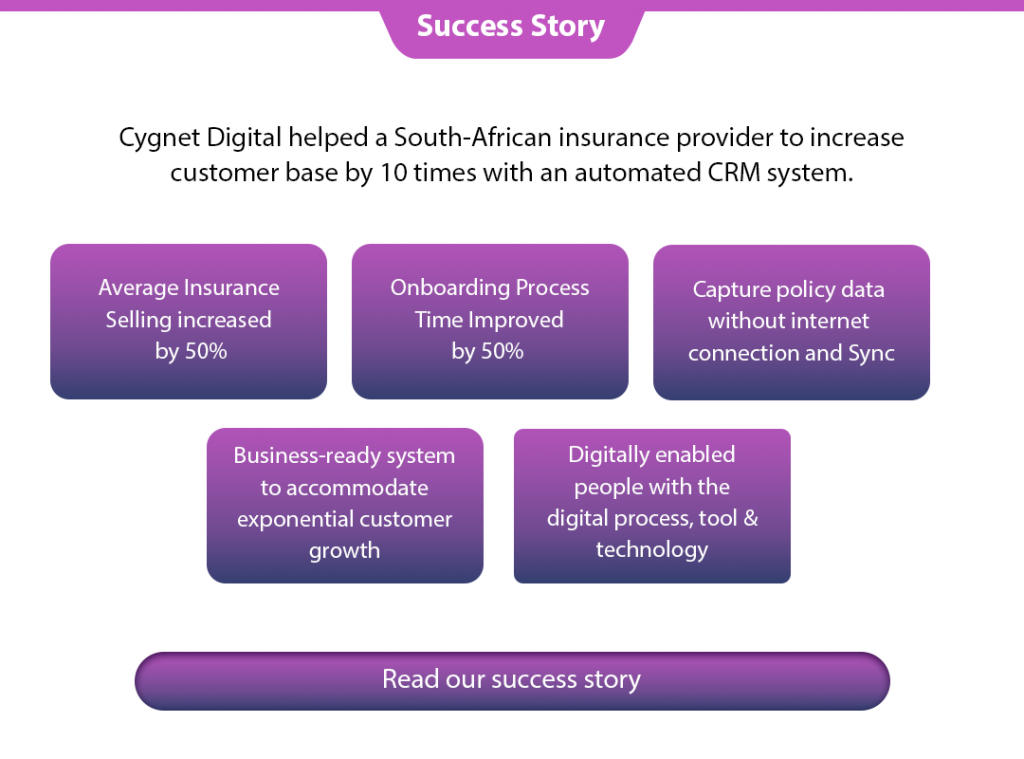

Real-World examples

The success stories of banks and insurance companies embracing hyperautomation serve as an inspiration to others. Financial institutions have reported significant improvements in operational efficiency, customer satisfaction, and revenue growth through the implementation of hyperautomation.

Future trends and opportunities

As technology continues to evolve, hyperautomation will witness further innovations. This transformative approach has the potential to create new opportunities and reshape job roles in the banking and insurance sectors. By enabling businesses to operate more efficiently, hyperautomation sets the stage for a dynamic future.

Conclusion

AI-powered hyperautomation has emerged as a game-changer in the banking and insurance industry. Its ability to combine AI, machine learning, and RPA in a cohesive manner offers unparalleled efficiency and optimization. Understanding the distinction between RPA vs. machine learning in automation is crucial—while RPA handles rule-based, repetitive tasks, machine learning brings adaptability and intelligence to more complex processes. Organizations that embrace hyperautomation will unlock the full potential of their resources and deliver superior customer experiences.

As the financial landscape continues to evolve, embracing the future of AI-powered hyperautomation is not just an option; it is a necessity. Banks and insurance companies must recognize the transformative potential of hyperautomation and position themselves as pioneers in the ever-evolving digital era.

Let Cygnet Digital be your technology partner in growth and innovation. Reach out to us today!

FAQs

While traditional automation focused on repetitive tasks, hyperautomation leverages AI and machine learning to enable systems to learn, adapt, and optimize processes independently.

Yes, data security is a top priority in hyperautomation.

Absolutely! Hyperautomation enables personalized interactions and efficient customer service, leading to improved customer satisfaction.

Challenges include data security, ethical AI use, and workforce adaptation to new roles.

While some roles may evolve, hyperautomation will also create new opportunities for employees to focus on higher-value tasks and innovation.